NEW SOUTH WALES

With the economy thriving and NSW’s capital city recording far stronger price gains than any of its rivals, 2014 has seen this state soar to new heights. Now the question everyone is asking is: how far can NSW go?

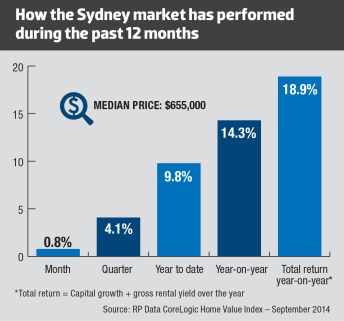

The magic number is 14.3%. That is the massive amount by which Sydney dwelling prices have grown over the past year, according to the RP Data CoreLogic Home Value Index results.

The next highest price growth was in Melbourne, at just 8.1%, and poor Canberra was bringing up the rear at 1.7%. Moreover, Sydney was also the best-performing capital city in the three months to September 2014, at 4.1%.

All this growth has helped Sydney’s median dwelling price creep up to $655,000. Not only is this more than double that of Hobart, but the NSW capital city also remains the only one to boast a median dwelling price above $600,000.

A big factor in this price growth has been the low interest rates, so things might start to get interesting if or when rates begin to go up in 2015.

Current state of the market

NSW has rocketed to the top of the rankings as the nation’s leading state economy, according to CommSec’s most recent State of the States report.

Indeed, it now boasts the fastest annual economic growth rate in the nation, which is up by 6.3% on a year ago, compared to WA at 3.3% and Victoria at 1.7%. Furthermore, annual population growth in NSW is the fastest it has been in five years.

“Sydney is the main location for overseas migrants, and migration has been running strong for the last couple of years,” says Angie Zigomanis of BIS Shrapnel.

Another high point for the NSW economy is housing construction, which is being fuelled by low interest rates and high investor demand. In fact, dwelling starts are over 36% above decade averages, and in the June quarter of 2014 the number of dwellings started was 7.3% higher than the previous year.

“NSW is currently ‘playing catch-up’ after years of under-building – where demand for homes exceeded supply, pushing the rental vacancy rate to record lows,” says the State of the States report.

The revival of the NSW economy at the moment is really down to the fact that it is enjoying a housing-led recovery, says Harley Dale, chief economist at the Housing Industry Association (HIA).

“The recovery in new housing is spreading to commercial construction as well, and there are more mixed-use developments going on in Sydney than there has been for some time,” says Dale.

“It’s only been in the last six to eight months that it has actually got to a volume of new housing supply which is commensurate with the needs of its growing and ageing population.”

The strong demand for property in Sydney is evident in its vacancy rate of just 1.8% (according to the Real Estate Institute of Australia), says Shane Oliver, chief economist at AMP Capital. This rate is the lowest in the nation, and low vacancy rates are indicative of an overall shortage of property.

The pick-up in economic performance has come after years of performing relatively poorly, says Oliver.

“Maybe the change of government helped on that front, from a couple of years ago. Obviously the lower interest rates have helped bring the property market back to life after a long period in the doldrums,” he says.

Australian Property Monitors (APM) chief economist Andrew Wilson argues that it is the solid performance of the NSW economy that is a key factor behind Sydney’s price growth.

Outlook: What’s ahead

Will the growth continue?

The NSW capital city is obviously growing very strongly in a median sense, says Dale.

“The price growth in Sydney is probably going to continue for a while. It comes off a decade in which Sydney was one of the worst-performing capital city price markets in Australia, behind only Hobart, so it’s playing catch-up, if you like. There is more short-term gain to be had in the Sydney market,” Dale says.

The QBE Australian Housing Outlook 2014–2017 report predicts total house price growth for Sydney of 13% for 2014/15 and 2015/16. However, the rate of growth is expected to begin slowing through 2015/16. Accordingly, Sydney’s median house price is expected to peak at $915,000 by June 2016.

“NSW’s stock deficiency is expected to ease over 2015/16, while affordability constraints are also expected to come to the fore as interest rate policy is tightened and variable rates rise,” says the report.

To put this in context, in the past 10 years Sydney has been one of the worst markets for new-home building in Australia, and it is now on to its third year of recovery, Dale says.

In a couple of years’ time, with the lag impact of a strong but probably slower rate of population growth than there is now, you will probably see a cyclical downturn in new homes in Sydney, says Dale.

Despite an increase in the number of apartments being built in inner Sydney – which is scheduled to continue over the next two years – BIS Shrapnel still predicts a modest deficiency of apartments in inner Sydney by 2016.

Meanwhile, there is a lot of chatter about either implicitly or explicitly restricting in some way the investor side of the lender market, which seems to be driving a lot of the price growth.

Arguably, the strongest growth in Sydney over the last 12 months has been in the middle suburbs, says Zigomanis.

“I wouldn’t be surprised if you saw the ripple effect move out into some of the outer suburbs of Sydney. And it also goes back to the ones that are the closest to decent public transport and social infrastructure,” he says.

Zigomanis also believes the NSW economy will, in fact, be the “star economy” of the states over the next few years. This is significant because, according to Wilson, the thriving NSW economy has been a major factor in helping push prices up.

There is also lot of infrastructure investment in the pipeline in Sydney, including some big road and rail projects.

“Some of those are going to have an impact on the ease with which the population can get from one part of the city to another,” says Dale. “We know that when infrastructure provision is closer to meeting the requirements of the population, that tends to be a positive for property prices.”

Sydney has underinvested in its infrastructure, and over the next five to 10 years it will be trying to play catch-up, says Dale.

According to John Edwards of OnTheHouse.com.au, very high-priced properties are likely to continue to grow in value because the wealthy don’t need to worry about such things.

“Sydney will become more and more a city of renters than anything else,” he adds.

Regional NSW: the next growth area?

Take away inflation, and house prices in regional Australia are growing at somewhere between 0% and 3% per annum, which is not strong price growth at all, Dale says.

“But with a lag you will start to see some house price growth in regional NSW – and other regional markets. So if you are an investor that is looking outside capital cities, I would suspect that, with low interest rates set to remain for some time, there are further gains to be had in regional property markets,” says Dale.

Investment in regional markets is about picking the markets where there is a relatively strong employment growth story, says Dale.

Newcastle

Newcastle is a big coal-exporting area and there has been a lot of investment in thermal coal mines. But prices have now dropped from about $115 a tonne in 2011 to less than $70 a tonne.

Even though there are other industries such as agriculture, winery and tourism, the downturn in mining has still had a big impact on the Hunter region, says Zigomanis. This helps explain why Newcastle is experiencing elevated vacancy rates at the moment.

Meanwhile, in central Newcastle, there is a train line running to the beach, and there are current plans to cut the line shorter to run light rail to the CBD and open up that waterfront area. This is an attempt to revitalise the city, which has been struggling in recent times, says Zigomanis.

“That may have some sort of positive impact, like more people wanting to live there and more apartment development,” he says.

A total of 15% price growth for Newcastle is forecast over 2014/15 and 2015/16, according to the QBE Housing Outlook. This is anticipated to increase in 2016 as affordability in Sydney becomes more challenging and outward migration picks up.

Wollongong

Wollongong has also experienced economic setbacks in recent years, yet it has the benefit of being closer to Sydney, with a lot more people commuting, says Zigomanis.

The local economy recently took a hit because of BlueScope’s decision to close one of its two furnaces, resulting in the loss of 800 local jobs. However, education and tourism are two industries in Wollongong that are supporting employment growth.

The situation in the local rental market is tight, with vacancy rates in the Illawarra region at 1.8% in June 2014, according to the QBE Housing Outlook. The momentum should see price growth continue to rise over 2014/15 and 2015/16, with a forecast increase in the median house price of 7% per annum.

Overall, the current price growth in the Sydney market will start to flow through to these other regional markets at a greater rate in the next 12 months, says Zigomanis.

Edwards agrees that it is areas like Illawarra and Newcastle that are headed for growth.

“And, if government can get its act together and get some very fast train lines going up to Canberra and/or along to coastal areas, then we will see strong growth in those corridors,” he says.

“That will have to happen. It mightn’t happen in the next 10 years, but it will definitely happen in the next two decades.”