NORTHERN TERRITORY

The Top End has been an economic powerhouse in recent years. But with many infrastructure projects finishing up soon, investors are left to wonder whether the NT still has much to offer

Darwin only has a population of approximately 130,000, yet has still managed to provoke jealousy in the other states due to its consistently high economic performance. “It probably punches above its weight, because it is a territory capital and there are a lot of defence and other things going on up there,” says Angie Zigomanis of BIS Shrapnel.

According to John Edwards of OnTheHouse.com.au, a big factor that contributed to the Darwin market taking off over the past decade was its very high level of rental returns.

“And it was fantastic for investors because what they could do was offset the negative gearing and high capital growth states of Sydney by investing in the Northern Territory and getting very high positive rental returns and cash flow,” he says.

“But that is not the case anymore. You could probably get some positive gearing up there, but it is not going to be terribly positively geared.”

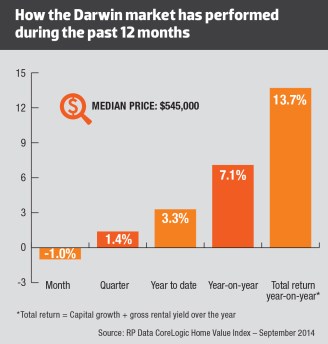

Over the past 12 months, Darwin has been the nation’s third-strongest performer, with a 7.1% capital gain in dwelling values, according to the latest RP Data CoreLogic Home Value Index results. Darwin is also the second most expensive capital city with a median price of $545,000.

Current state of the market

NT may have a tiny economy, but it has performed very well in recent years, says Edwards. Its resources projects are now moving from the construction phase into production. “And at the same time you have got a very transient workforce and population,” he says.

The latest CommSec State of the States report has the Top End as the nation’s third best performing economy. It boasts the top position on five indicators, with low unemployment and equipment investment driving growth.

Economic activity in the NT is just over 34% above its normal or decade-average level of output. However, its economy is down 1.2% since 12 months ago, which indicates that its top ranking for economic activity compared with the decade average may be at risk.

What’s promising is that the NT has finished first in the retail rankings, with spending in the June quarter 17.2% above decade-average levels. Spending has been fuelled by solid wage growth and low unemployment.

NT has the strongest job market in the nation, the report says. In trend terms it has the lowest unemployment in the nation at 4.3%, and its jobless rate is just 1.5% above its normal or decade-average level of 4.2%.

However, the report also says that attracting labour to the Top End remains a constraint on growth.

Overall, it has tended to be a very volatile market, says Harley Dale of the Housing Industry Association. “Darwin does ebb and flow depending on the resources projects. And it is ebbing at the moment,” he says.

According to QBE’s Australian Housing Outlook 2014–2017, price growth was varied across Darwin in 2013/14. It was strongest in the inner suburbs (13.2%) and Palmerston (6.5%), yet there was a fall of -1% recorded in the northern suburbs.

Moreover, new dwelling commencements, which reached their highest level in 16 years in 2012/13, remained high in 2013/14. This has predominantly involved the apartment sector and is reflected in record levels of investor demand.

Outlook: What’s ahead

High vacancy rates a worry

According to the Real Estate Institute of Australia, Darwin has a vacancy rate of 4.4%, which is the nation’s highest for a capital city.

“I think as the mining boom fades away it’s going to mean more upward pressure on vacancy rates,” says AMP Capital’s Shane Oliver.

Furthermore, Edwards says the NT’s population is falling. “Over the last five years, there was an increase of 593 people per quarter. But currently they are down by 574 per quarter,” he says.

And despite the huge amount of spending that’s taking place, there is not much hope for growth, Zigomanis says. “It’s at a point where it’s got maximum workers, maximum spending, maximum … There is no growth coming through. It’s not attracting more people and more money into Darwin than it already is.”

Construction is strong

Apartment construction in Darwin is likely to stay strong for at least another 12 months, Zigomanis says. “But whether it tips the market into oversupply when it all starts to wind down is another question. That’s a risk.”

There has been a fair bit of development of medium- to high-density stock in Darwin in a short space of time, says Dale.

“This sort of stock is not a traditional living product for Darwin. And it might have been a bit overdone. But in terms of an investment you wouldn’t jump into an apartment in Darwin anyway. However, this particular supply issue should iron itself out in the short term,” he says.

“The semi-detached housing market still has a way to go.” According to the latest Herron Todd White report, the rules surrounding buying dwellings will continue to have a strong impact on certain property types. Given the stamp duty concession for new builds only, we will continue to see the softening of the old stock as new developments near completion, says the report.

Investors should look at sitting on a property for 10 to 15 years, and they will get good returns, Dale says.

“Just as they would have over the last 10 years,” he adds. “It is a bit of an esoteric market when it comes to research and analysis, though. You really need to be out there on the ground talking to locals.

“In the long term, it is resource rich and has good inherent rental capacity.”

The Darwin median house price is expected to experience total growth of 2% over the three-year forecast horizon, taking the figure to $635,000 at June 2017, according to QBE’s Housing Outlook. This would actually result in a 7% decline in the median house price.

“However, if sufficient new investment does not commence as the Inpex LNG project winds down, the potential exists for a larger decline by 2016/17,” says the report.

Uncertain future for LNG

Inpex’s $34bn Ichthys LNG project is scheduled to be completed in 2016, and it is likely that investment levels in the NT will moderate considerably after that, according to the most recent Deloitte Access Economics Investment Monitor report.

“The share of investment in the Northern Territory’s economy is forecast to slow over the next decade as current projects reach completion, with the large Ichthys LNG project accounting for over 50% of current investment,” says the report.

When the LNG project does wind down – and unless there is something decent behind it – the market will probably weaken in Darwin, agrees Zigomanis. “It will be beyond the next 12 months, but it will happen. If you throw out a huge multibillion project, it has a huge impact on a small population.”

Asia: Darwin’s saviour?

As Asia is one of the fastest-growing regions in the world – which is projected to be home to half of the world’s middle class by 2020 – it is Darwin that’s set to benefit. The NT capital is looking like building on its reputation as Australia’s gateway to Asia.

At the moment, 55% (or $121bn) of Australia’s exports are shipped from the northern ports. Additionally, according to the Bureau of Infrastructure, Transport and Regional Economics, the value of exports through Darwin’s port has increased, with an average growth rate of more than 12% a year over the five years to 2012/13.

Furthermore, it seems there is potential for increased exports from current and new mines in the NT and of LNG from the Browse Basin.

The federal government is also looking at agricultural development at the Top End, says Edwards. This includes the potential for more live cattle and beef exports. In fact, a new abattoir that’s able to process up to 200,000 head nationally is under construction south of Darwin.