SOUTH AUSTRALIA

Its economy may not look fantastic on paper, but there is still plenty to like about the future South Australia. Investors would be wise not to dismiss this state, especially in the long term when the Olympic Dam expansion gets underway, say commentators

Mention the words ‘South Australia’ to a seasoned property investor and you’re likely to get a shrug that says, “Why should I care?”

However, a look beyond the headlines reveals a state that’s affordable, with opportunities for good capital growth and rental returns, particularly in Adelaide.

And even the headlines themselves sometimes bring positive news. For example, in recent times Adelaide has been named one of the best cities, not just in Australia but all over the world.

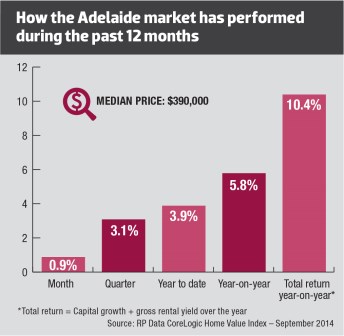

In fact, according to the latest RP Data CoreLogic Home Value Index results, dwelling prices in Adelaide grew by 3.1% in the September 2014 quarter, making it the third-strongest performer of all the capital cities. Could this be a sign of things to come?

Current state of the market

The SA economy has not had much cause for celebration in 2014. It has been hit hard by a high dollar because of its reliance on manufacturing, and by delays in some big resources projects getting off the ground, says Harley Dale, chief economist at the Housing Industry Association (HIA).

CommSec’s latest State of the State report indicates that SA is currently the nation’s sixth-strongest economy and is generally ranked sixth to eighth on the key indicators.

It also shows that SA is the nation’s weakest state for retail spending, as it is up just 4.2% on the decade average.

But despite the gloom surrounding employment in the manufacturing industry, the state’s jobless rate fell from 6.8% in May 2014 to a 15-month low of 6.3% in September. Consequently, SA is now ranked third on unemployment.

Additionally, SA’s population growth of 0.93% has been the fastest in 18 months, though it’s still 3.3% below the decade average.

Further good news is that the wage growth of 3.1% over the past 12 months is the fastest in the nation. And even though the high Australian dollar seems to have impacted on a number of SA industries, it has recently been falling, says Zigomanis.

Adelaide’s property market is also showing signs of progress, according the latest Herron Todd White report.

“Currently, Adelaide’s property market continues its steady improvement, showing increasing capital growth, above average auction clearance rates, reduced time on the market and less vendor discounting,” says the report.

According to the latest RP Data figures, the median dwelling price in Adelaide is the second lowest in the country at $390,000. And its year-on-year growth of 5.8% is superior to Perth, Hobart and Canberra.

Median house price growth was the highest in the inner suburbs of Adelaide (6.7%) and the weakest in outer Adelaide (1.5%), according to the QBE Australian Housing Outlook 2014–2017. Furthermore, it reports that SA’s vacancy rates have been tightening from levels well above 3% as at June 2012, to current levels below 3%.

Outlook: What’s ahead

What’s in it for investors

SA is an affordable market relative to other capital cities, says Zigomanis. “There are good things happening there, like upgrading the transport network from diesel to electric trains.

“Arguably, as a city it is more cultural than Brisbane, so it might attract a certain type of person,” he adds.

Yet it’s the attractive incentives for new construction for all market segments in Adelaide that have helped contribute to a recovery in dwelling activity, according to the QBE Housing Outlook. However, there is a risk that vacancy rates will trend upwards again over 2014/15 as these dwellings work their way through to completion.

“Total median house price growth of 5% is forecast over the two years to 2015/16, before the combination of rising oversupply and interest rates slow price growth into 2016/17,” says the report.

In particular, the short-term outlook is really not a strong one, says Dale.

“Price growth will be modest. There was a short, sharp recovery in home-building activity that has subsequently petered out. There is not as much life in the Adelaide market as compared to some markets in larger capital cities,” he says.

Manufacturing: on life support?

There has been much anxiety surrounding the closure of Holden’s manufacturing operations, but it’s important to put it all in perspective, says the most recent Deloitte Access Economics Business Outlook report. The number of jobs directly lost in SA is 2,000, which is not that bad when you consider the state has an employment base of 800,000 people.

Moreover, it will not actually be until 2017 that General Motors ceases its car production operations in SA. And even though SA has a large car and parts manufacturing sector compared to other states, it is not actually a major part of SA’s wider economy.

In addition, the submarine fleet needs to be upgraded soon, says Zigomanis. However, at the moment the federal government is planning to buy them from overseas, most likely Japan, which could come at the expense of Aussie jobs.

“The last lot were predominantly built in SA, and the next batch they are weighing up: What’s the cost? Do we build them here again, or do we build the stock-standard product off the shelf from some other country and just do the maintenance stuff here? What happens there will impact, to some extent, on jobs in Adelaide as well,” says Zigomanis.

Because SA’s industrial base has been weakened, this limits its capacity to take full advantage of the falling Australian dollar and low interest rates, says Shane Oliver from AMP Capital.

Why the Olympic Dam is a sleeping giant

Looking at the long-term horizon everybody keeps talking about the Olympic Dam expansion, says Zigomanis. “It’s going to be there for 40–50 years as a project. And as such, you don’t build it now when there has been so much activity going on Dwelling prices in Adelaide grew by 3.1% in September 2014, making it the third-strongest performer of all the capital cities and prices are through the roof,” he says.

“You just sit and wait until you can build it as cheaply as possible. Towards the end of the decade they might start to look at it again, but for now it’s on the back-burner.”

John Edwards of OnTheHouse.com.au concurs that, while it may be in the long term, it finally looks like BHP has come up with a method for making the Olympic Dam work.

“And that could change things. It’s a leaching process that they are about to trial, but that is not something that will impact in the short term,” he says.

But Edwards argues that SA’s mining sector should not be underestimated.

“Like WA, SA has very significant mineral resources. When you get out to Eyre Peninsula you have got graphite, and there is uranium in the inland,” he says.