Tasmania

Plagued by the fallout from the state’s economic challenges, Tasmania’s property market has struggled for years. But there are flickers of promise which indicate that, while a dramatic short-term improvement is unlikely, there is some hope for the future

'Doing it tough’ has been a slogan much applied to the old Apple Isle in recent years. Significant economic challenges and the resulting fallout mean that Tasmania, and its property market, have suffered.

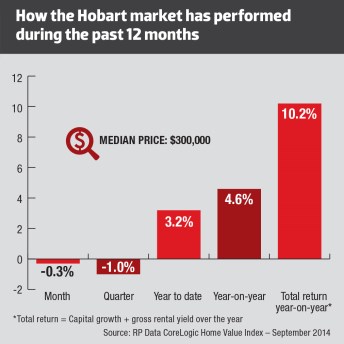

According to the latest RP Data CoreLogic Home Value Index results for September 2014, Hobart was one of only two capital city markets to record a decline in dwelling values (of -1.0%) over the quarter. It did, however, record year-on-year growth of 4.6%.

This means the city retains its crown as the most affordable capital city, with a median price of $300,000.

There are also signs of a nascent upturn, with the latest Real Estate Institute of Tasmania (REIT) June quarter data showing the highest number of house sales since the June quarter of 2010.

A 5.7% state-wide increase in house sales meant the market was up 10.1% for the year. The REIT data also showed a 2% increase in the median house price for the quarter.

These results don’t indicate a spectacular turnaround in fortune, but they do indicate a tentative improvement in the market.

Current state of the market

Lack of enthusiasm tends to dominate discussion of the current state of Tasmania’s market. Those hints at improvement just don’t seem strong enough to inspire optimism.

However, Deloitte’s latest Business Outlook report paints a more promising picture than many would expect. Tasmania is moving to the beat of a different drum and, while it has underperformed the nation over the last decade, that gap is currently narrowing, the report says.

Construction is growing, retail sales are solid, there has been some improvement in job growth (and a related fall in the unemployment rate), and population growth recently hit a two-year high. This is all in contrast to national trends.

Although things are looking better, this is partly due to a catch-up after a rotten run, the report continues. Business investment spending may have lifted, but it remains a smaller share of the economy than in any other state. Further, population growth is rising, but it is still the weakest of any state.

BIS Shrapnel’s Angie Zigomanis says Tasmania’s property market has also been stronger of late. But the increased activity was largely driven by the First Home Owner Grant, which has now expired.

Tasmania’s government also offers a first home builder grant of $30,000, which is having a positive impact on construction, he says. “But, unless that population turns round, it is going to exacerbate any existing oversupply – because you are taking all those people out of the rental market and leaving empty dwellings behind.”

The QBE Australian Housing Outlook 2014–17 report backs up the views of Zigomanis.

It notes that the rise in the median house price was from first home buyer demand, and that, with the grant gone, purchaser demand is likely to slow. And it states that the increased construction activity is likely to push the market further into oversupply.

None of this bodes well for property price growth in the near future.

Outlook: What’s ahead

Given that the faint indicators of better times ahead continue to be tempered with words of caution, what then should investors make of Tasmania in the year to come?

Well, not that much, according to the experts we spoke to. Housing Industry Association (HIA) chief economist Harley Dale says the state’s fundamentals are simply not that strong. Hence it is the weakest-performing market in Australia and – due to its slow population growth and ageing population – that is not likely to change in a hurry.

There was a sizeable price decline, but that has levelled out and the market has probably found a base price level now, he says. “There is a bit of new-home building going on. This reflects an increase in confidence, as well as government assistance. The certainty that comes with a majority government has helped a broader confidence boost.”

Overall, Dale thinks the state’s outlook is challenging. “However, as a small state, if government was to engage in some reform or innovation to create economic opportunities, and thus employment opportunities, it could perform better than people think.”

The new majority government is the key to the future, OnTheHouse.com.au consulting analyst John Edwards agrees.

In his view, Tasmania has potential, but it is difficult to see what could be done to actually get things happening for the state. “We have to watch and see how that new government performs and what it does to try and stimulate the economy.”

Possible positives

For the time being, the state and its property market is likely to keep plodding along much as it has been, AMP Capital chief economist Shane Oliver says.

Some promise for Tasmania can be found in the lower Australian dollar, which is likely to help tourism, and in the affordability of property. There is a theory that after a period of strength in Sydney and Melbourne you start to see people looking south to Tasmania, and people do retire there too, Oliver says.

“This can provide a bit of a boost. In Tasmania’s relatively low-cost market – the average dwelling price [average of house and unit prices] is $310,000, compared to Sydney, which is $650,000 – there is value to be had. So, to the extent that strength continues in Sydney and Melbourne, you might get some spillover benefit for Hobart.”

Unfortunately, there are no big-ticket, game-changer items on the cards for the Apple Isle. Nor is there any particular sector that will carry the economy onward and upward.

Zigomanis points out that Tasmania was the first state to get the national broadband network, which might attract hip young entrepreneurs and start-ups. Further, there could also be a bit of a ‘halo’ effect from the Museum of Old and New Art (MONA). However, whether or not these factors will have a significant impact on the property market is uncertain.

On a more positive note, Zigomanis says the latest data suggests there might be a positive figure for migration into Hobart in the next quarter. “We expect Tasmania to move back into a net interstate inflow. That will be a positive for the market as it creates more spending, jobs and growth.”

He, too, thinks the state’s affordability might help it out, as it has in the past.

Forecast for investors

According to QBE’s Australian Housing Outlook, without employment growth and with excess dwelling stock in the market, future price growth is likely to be modest and mainly underpinned by low interest rates.

The median house price is forecast to rise by 1–2% per annum, or a total of 5%, to $400,000 by June 2017, the report says. In real terms this is actually a price decline of 4%.

But Zigomanis argues that the situation is not as depressing as the pictures that are painted. The state has less scope for prices to shoot upwards; rather, they will just meander up a bit.

“There will be pockets of nice yields there as well. It’s just finding a tenant that is the issue. There are some parts of Tasmania that are better than others. But it might be a bit of luck as well. It’s about picking winners.”

Meanwhile, both Dale and Edwards recommend waiting, watching and keeping an eye on the market. There are risks, they say, but it might be possible to pick up a good entry-point deal.