Victoria

Melbourne’s surprise turn as one of the property market’s star performers has continued for longer than most predicted. But a combination of factors means the good times are not expected to roll for much longer

Dynamic, cosmopolitan Melbourne has always been full of surprises. And over the last 12 to 18 months it has served up a stunning period of price growth that has knocked most commentators for six.

According to RP Data, since the beginning of 2009 Melbourne values have gone up by almost 45%. In 2013 it recorded growth of approximately 9–10%, according to QBE, and in 2014 its growth continued to defy the naysayers.

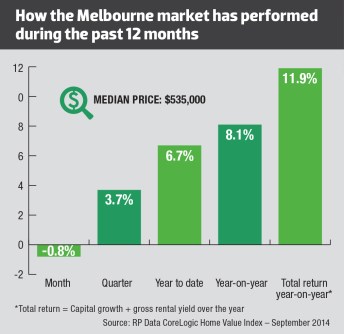

While the latest RP Data CoreLogic Home Value Index results for September 2014 show a fall 0f -0.8% over the month, the city still recorded healthy growth of 3.7% over the quarter. Further, year-on-year growth was 8.1%.

This growth has largely been driven by the state’s strong population growth, most of which is based in and around Melbourne. Property purchases and residential construction have both benefited from the increases in population.

However, changing circumstances mean the forecasts for the Garden State’s capital market aren’t quite so rosy in the coming years.

Current state of the market

A certain sense of wonder has dominated coverage of Melbourne’s property market of late. Tales of fevered auction weekends, strong price increases and ongoing value growth have combined to gloss over some of the rough spots that are starting to emerge.

Thanks to its stellar population growth, Melbourne has been a strongly growing property price market for some time, Housing Industry Association (HIA) chief economist Harley Dale says. But the state’s economy is weakening and unemployment is relatively high.

“Victoria has been exposed, for a number of years now, to having a large manufacturing sector with an elevated currency. Even though the Australian dollar is falling now, the horse has already bolted, in a way, in terms of the next year or two.”

OnTheHouse.com.au consulting analyst John Edwards agrees, and adds that Victoria’s government grew the state by encouraging large numbers of people to immigrate, which encouraged construction. And the state has lived on that – but now the chickens are coming home to roost.

“You can’t build much more property, because you are getting an oversupply … Also, what are you going to do when the people come in? How do you employ them? The state has to find another raison d'être.”

Victoria’s economic and employment issues could be compounded if population growth eases as is predicted. However, at this point, population growth remains solid.

This is largely because, as a place to live, Melbourne is pretty nice, BIS Shrapnel’s Angie Zigomanis says. It also has relative affordability on its side: Brisbane is not much cheaper than Melbourne.

“Despite the tougher times, Melbourne probably has more depth to its employment market, in terms of jobs, than most other cities. Apart from Sydney, which is very expensive, if you are living in Melbourne where else would you go? None of the other employment markets are booming.”

So, while the state might not be attracting as many people as it once was, people are not leaving in the same numbers as in the past. This is providing demand for housing, and fuelling the construction industry.

Outlook: What’s ahead

Once those brewing economic headwinds do hit home, the Garden State’s capital market will have to face some difficult times.

As manufacturing declines further, it is uncertain exactly what will drive the economy in its place, Edwards says. He suspects Victoria will somehow pull through, but the growth seen there in the last decade won’t be repeated in the next.

This view is backed up by the QBE Australian Housing Outlook 2014–2017, which states that the high number of new dwellings in the pipeline is likely to tip the market into oversupply from 2015/16. Not only will this cause vacancy rates to rise, but price growth will progressively weaken.

The situation will be further compounded when interest rate policy begins to tighten. With variable rates forecast to peak at 6.8% over 2016/17, this will take Melbourne’s affordability close to 2008 and 2010 levels, the report notes.

In the past, similar conditions have resulted in price correction. Therefore the report predicts a 1% fall in house prices in 2016/17. The end result will be 5% total growth over the next three years, which is a 4% decline in real terms.

Dale says the rate of property price growth in Melbourne will slow more quickly than in Sydney. “It is important to recognise that Melbourne is the most mature capital city in terms of its property upcycle. This means its rate of growth is going to peak, slow and bottom out sooner rather than later. So don’t look back over the past few years and expect them to be replicated, because they won’t be.”

Population growth will be a crucial factor in this situation, Dale says. The demand created by strong population growth, along with low borrowing costs, has countered the weak economy and the underperforming labour market.

“If you were to see a material slowing in the net overseas migration coming into Victoria in the next little while, as you are looking at rising interest rates in 2015 and a weakening economy anyway, that would not be a good combination in terms of short-term housing prospects.”

Potential for oversupply

The question of whether Melbourne is looking down the barrel of an oversupply problem remains controversial. Yet, while commentators disagree on the extent of the problem, most agree that the market will slip into oversupply in the near future.

Zigomanis says Melbourne has gone through a big surge in residential construction, particularly apartment construction, over a sustained period. Without its strong population growth, he thinks the city would have already been in oversupply.

As it stands, the Melbourne market is close to balanced, which impacts on its overall outlook, Zigomanis says. It probably has another 12 months of growth left in it, and then that oversupply will kick in and impact on prices.

“It doesn’t have the level of pent-up demand that Sydney has… So, in about 12 months, you will start to see vacancy rates rising sharply and the market getting tougher out there, particularly if interest rates start rising.”

However, Dale argues that it is just the inner-city Melbourne apartment market which has been oversupplied with certain types of stock. In his view, the state’s population growth rate means that, even if there is an oversupply, the overhang might be worked through relatively quickly.

Elsewhere, he says, Victoria has had a very strong market for new-home building, which resulted in parts of the market being oversupplied a few years ago. But a couple of years of modest market correction took care of that.

“Subsequent to that, on the detached housing front at least, there is a recovery underway again in terms of housing supply. So the market has acted as you would expect it to.”

Dale does add that, due to the extended period of new supply, across a range of different dwelling types coming on to the market around Victoria, there is unlikely to be any improvement to the state’s consistently low rental yields.

Forecast for Victoria’s regional cities

Despite the tougher economic times ahead, the prospects for Victoria’s major regional cities look a little brighter. For a start, AMP Capital chief economist Shane Oliver believes the price growth seen in Melbourne will get pushed out to the regional centres.

According to the QBE Australian Housing Outlook, the major regional cities of Geelong, Ballarat and Bendigo are likely to benefit from a convergence of factors. These include the timing of Melbourne’s residential cycle, the relative house prices which drive migration between the capital and regional centres, and new infrastructure, notably the completion of the Regional Rail Link.

As Melbourne's affordability index rises, these regional centres are likely to present an increasingly attractive alternative. With the rail link in place, commuting will become a valid option for many people.

The report notes this has the potential to drive increased migration into these areas. This would increase demand for dwellings and create some upside for price growth.

In the meantime, the report predicts that:

Bright spots for 2015

While the outlook might seem gloomy, all is not lost for investors interested in Melbourne. There are pockets of promise in the city.

Edwards says lower-cost properties will always have growth, and, likewise, properties around employment hubs are a sensible bet. “There are some new employment areas opening in Melbourne. For example, CSL has developed a very large pharmaceutical plant out towards the airport, and that is providing job opportunities. There is likely to be growth in that sort of area.”

Areas around the East West Link could be good to keep an eye on, Dale suggests. “It looks like a good project that will assist the moveability of the city. And you would think that with that would come commensurate property opportunities related to the whole infrastructure project.”