Property is back in the news and making headlines again.

But in a very different way to this time last year.

Nationally, property values recorded the fourth consecutive month of growth in October taking growing value 2.9% higher of the quarter.

So rather than being worried about property Armageddon, now the commentators are asking how strong the markets will be with a recent forecast suggesting dwelling prices could rise by more than 15% in Melbourne and Sydney next year.

After struggling for two years, the Australian housing markets are on the up, now delivering positive growth for 4 months in a row.

But what is really ahead for our property markets for 2020?

To put some reality into the forecasts I had a chat with, Dr. Andrew Wilson chief economist of myhousingmarket.com.au

It’s that time of the year again.

Spring has sprung, the flowers are out, and a little creature comes out of hibernation at this time every year – it’s called a property forecaster.

And they’ve been out in force lately with widely varying claims.

Recently SQM Research’s annual Housing Boom and Bust Report suggested that most of Australia’s capital cities will benefit from the interest rate cuts and loosening of credit restrictions to record dwelling price rises over 2020 with Sydney and Melbourne leading the charge.

SQM’s base case forecast is for dwelling prices to rise between 7% to 11%, which is a strong bounce back from the price falls recorded over 2018 and the first half of 2019.

SQM forecast Sydney property values to rise between 10% to 14% and Melbourne property prices to rise 11% to 15% next year

On the other hand the CBA Bank has a more modest forecast but still dramatically corrected an earlier ‘modest’ prediction as FOMO returns to the market.

The bank, which predicts a national property price rise of 6 per cent, said the demand for lending was driving the price surge, noting ABS lending data that showed an astonishing 52 per cent increase in the flow of housing credit in the four months to September.

“Our base case for property prices in Sydney and Melbourne has them rising by 7 per cent and 8 per cent respectively over 2020,” the report concludes.

Brisbane and Canberra will follow with four per cent gains, with Adelaide and Hobart house prices to grow three per cent.

Brisbane and Canberra will follow with four per cent gains, with Adelaide and Hobart house prices to grow three per cent.

There's finally good news for Perth and Darwin. After major losses, the two strong mining capitals aren't expected to see declines in 2020 according to the CBA.

Perth is forecast to see 2.5 per cent growth, while Darwin will remain flat according to the CBA.

I tend to agree more with the CBA’s forecasts – double digit capital growth is unlikely next year as our economy and our property markets face a number of headwinds.

Sydney and Melbourne property price growth peaking

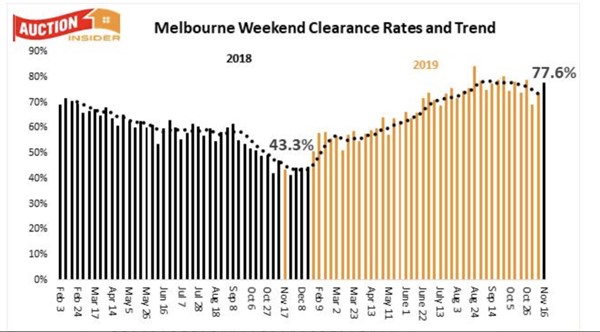

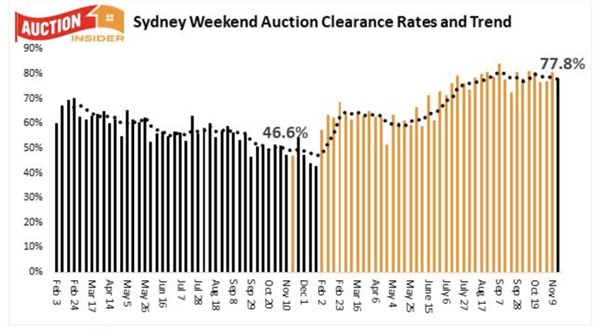

The robust turnaround of the Melbourne and Sydney property markets has surprised most commentators.

Our two big capital cities are in catch up mode after suffering significant price falls, but following a strong early spring performance, property price growth in the Melbourne and Sydney housing markets seems to have peaked over the last month.

The typical late spring rise in property listings has acted to stabilise auction clearance rates with buyers provided with more choices compared to previous months.

Melbourne and Sydney housing markets are likely to regain all their recent losses in the first half of next year, but then I see prices rising more moderately.

Interestingly despite enjoying the same low interest rate environment, Brisbane, Canberra, Adelaide and Hobart have not experienced the property price surge that Sydney and Melbourne have, and that is most likely because these smaller capitals did not experience a significant property downturn.

This suggests that when Sydney and Melbourne dwelling values reach new peaks, as they will next year, price growth will moderate.

Good and bad news in the economy

Another reason I can’t see double digit house price growth in 2020 is that the Australian economy isn’t improving as fast as the RBA would like, however there are some good things happening that we shouldn’t ignore.

First let’s look at some of the challenges our economy is facing:

Unemployment is on the rise again as jobs fall for the first time in three years.

The unemployment rate jumped back up to 5.3 per cent in October.

This makes the Reserve Bank's target of full employment at 4.5 per cent, or lower seem less attainable.

On top of the rise in unemployment, underemployment — or the number of workers looking for more hours — rose too, taking the underutilisation rate up to 13.8 per cent, the highest level in more than a year.

Retail spending is languishing

Home owners are stashing their cash and paying down debt rather than spending meaning that retail sales are sluggish despite three interest rate cuts.

Business Confidence is poor

Investment in new products, equipment, factories and employment have been put on hold.

Some business owners are worried about a local recession, others are concerned about things like the US China trade war, Brexit and geopolitical problems such as Hong Kong.

Our Government are holding back spending

Treasurer Josh Frydenberg doesn’t want to increase government spending or give cut taxes just yet.

He’s waiting to deliver a surplus in his first budget before spending more and hoping in the meantime our economy will rebound.

But there’s also good news:-

• First home buyers are back and will create a significant impact early next year as they take advantage of the upcoming government incentives that will allow them to enter the market with a 5% deposit.

• House prices are rising and will continue to do so in 2020. The Wealth Effect this will bring suggests spending should pick up as homeowners become more confident when they feel their properties are more valuable.

• The mortgage arrears rate, at 1 per cent, is very low. There is no fear of a debt bomb exploding as some of the pessimists keep suggesting.

• There are signs that consumers are starting to spend with the average credit/charge card balance up by 3.8% on a year ago at $3,336.78 in September– the strongest annual growth rate in 10 months.

• The Trump trade deal news is progressively getting more positive.

The bottom line:

We are at the beginning of a new property cycle and property prices will continue to rise, driven by strong population growth and a relative undersupply of the right type of property.

However, it is unlikely that we will experience double-digit property price growth in 2020.

For that to happen investors will have to re-enter the market, as is it is investors and not home owners that tend to create the booms and busts of our property cycle.

Currently investors are having difficulty obtaining finance and if the property markets boom again, I can see APRA stepping in to restrict investor finance as they did a few years ago.

However, if our economy remains stable, interest rates fall again and APRA stays on the sidelines, property values will be significantly higher at the end of 2020 than they are now.

With thanks to PropertyUpdate.com.au and MyHousingMarket.com.au