Confidence in Australia's housing markets has leapt in the last few months with most property commentators forecasting property values will finish the year off higher than they are today.

Buyers are back making plans, looking at properties and approaching their lenders for finance.

They are buoyed by falling interest rates and the prospect of more rate cuts to come and a generally positive media.

As a result, auction clearance rates are up, asking prices are up, and many are suggesting we’ve hit the market floor.

So to explain what’s happening in our property markets and to give as some forecast of what’s ahead let’s chat with Australia’s leading housing economist – Dr. Andrew Wilson, chief economist of MyHousingMarket.com.au

Watch as we discuss this months news:

Interest rates are forecast to drop further.

Over the last couple of months the RBA cut interest rates twice and a further rate cut is expected in October or November, but now Bill Evans, chief economist of Westpac has forecast that interest rates could be cut twice more in the RBA’s quest to raise inflation into its desired band of 2-3% and to drop the unemployment rate to 4.5%

However lower interest rates haven’t stimulated employment or significant economic growth overseas and are not likely to have the result the RBA hopes for here either.

This means the RBA is going to be challenge by its forecasts and it will take a couple of years before it can get inflation to within this target range.

With regards to unemployment, it this like an even more difficult task to get unemployment to the range that the RBA is hoping for even with the stimulus we are seeing with interest rates and the tax cuts.

New building approvals slump

The latest ABS figures show that Unit and townhouse approvals have crashed nearly 40 per cent lower year-on-year, driven by Sydney, Melbourne, and to a somewhat lesser extent, Brisbane.

June was the lowest month for attached dwelling approvals in Sydney in more than six years.

The annual total for house approvals was also well down across Sydney (-13 per cent), Melbourne (-12 per cent), and Brisbane (-21 per cent).

And the month of June also rounded out the lowest ever year for public sector approvals, with the government effectively bowing out of providing new accommodation altogether, at least in terms of net additions.

Piecing it all together dwelling approvals were down 26 per cent over the financial year to about 14,300 in June, in seasonally adjusted terms.

Annual approvals have thus fallen from 239,000 in FY2016 to just 187,000 in FY2019.

So the cycle moves on….once the existing supply of dwellings is cleared down there will be shortage of rental accommodation in the major capitals.

.jpg)

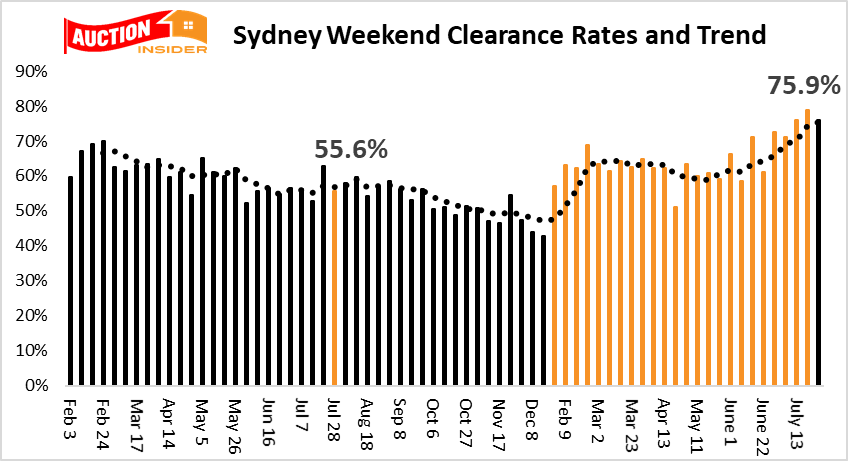

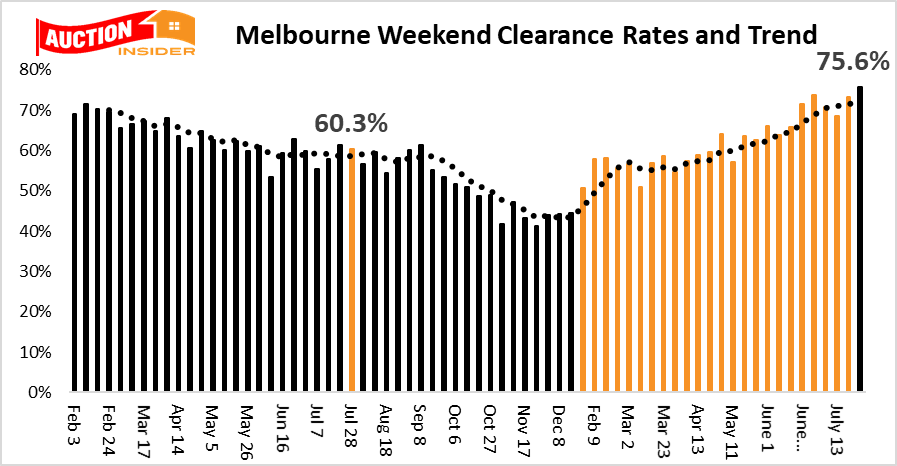

Auction clearance rates point to higher prices ahead.

Auction clearance rates in both Melbourne and Sydney kept rising over the last month continuing the post-election bounce in confidence in our property markets.

The prospect of easier access to finance, falling interest rates and a tax cut has boosted confidence, driving strong auction results across Australia.

However the number of properties offered for auction was once again low this weekend, but with these types of results more sellers are likely to be prepared to place their properties on the market.

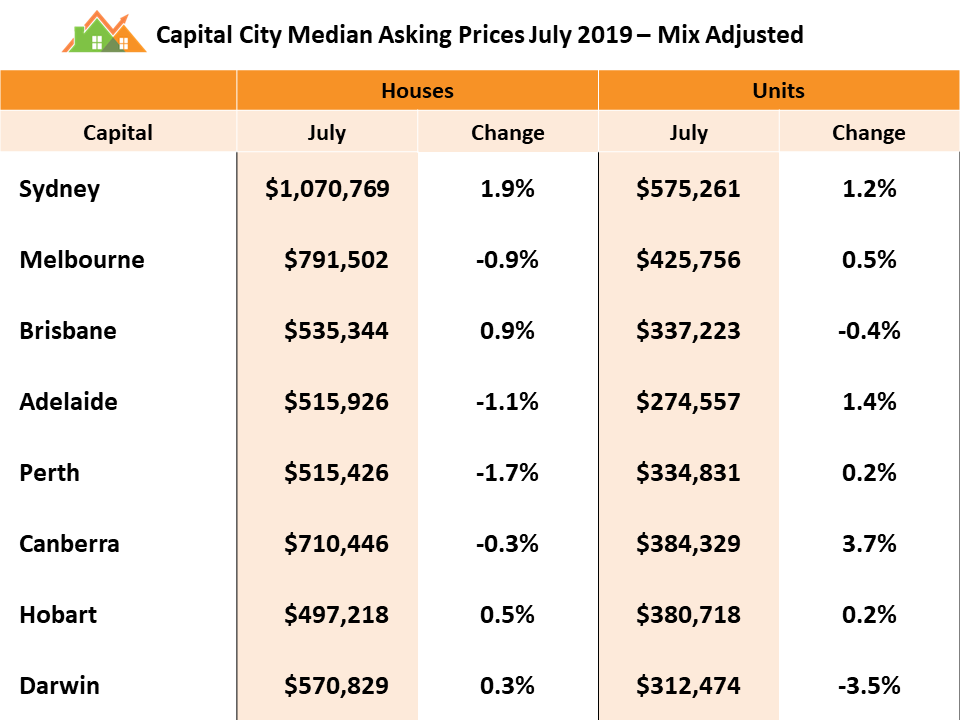

What’s happening to asking prices?

While median prices are often seen as the gauge of how the market is performing, these are a lagging indicator, demonstrating what happened a couple of months ago.

Asking prices are a more timely leading indicator, while weekly auction clearance rates are by far the most timely gauge of conditions across Australia’s housing markets, bigger real-time indicator of what is happening, especially in two big property markets Sydney and Melbourne.

Have we hit the bottom yet?

The Sydney housing market is showing strong signs of having reached the bottom of the cycle.

Overall property values are likely to rise modestly to the end of 2019 before growing about 3 per cent in 2020.

It’s a great time to buy countercyclically in Sydney and Melbourne and ride the property next wave of the property cycle in Brisbane.

The downside for these capital city markets is minimal and there is now plenty of upside ahead over the next few years.

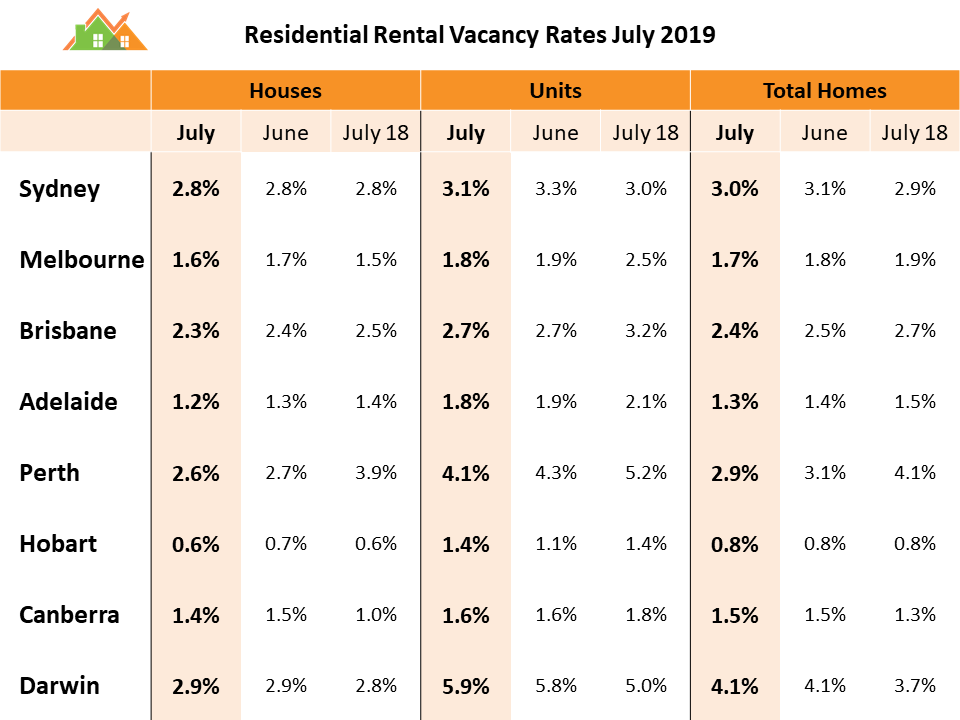

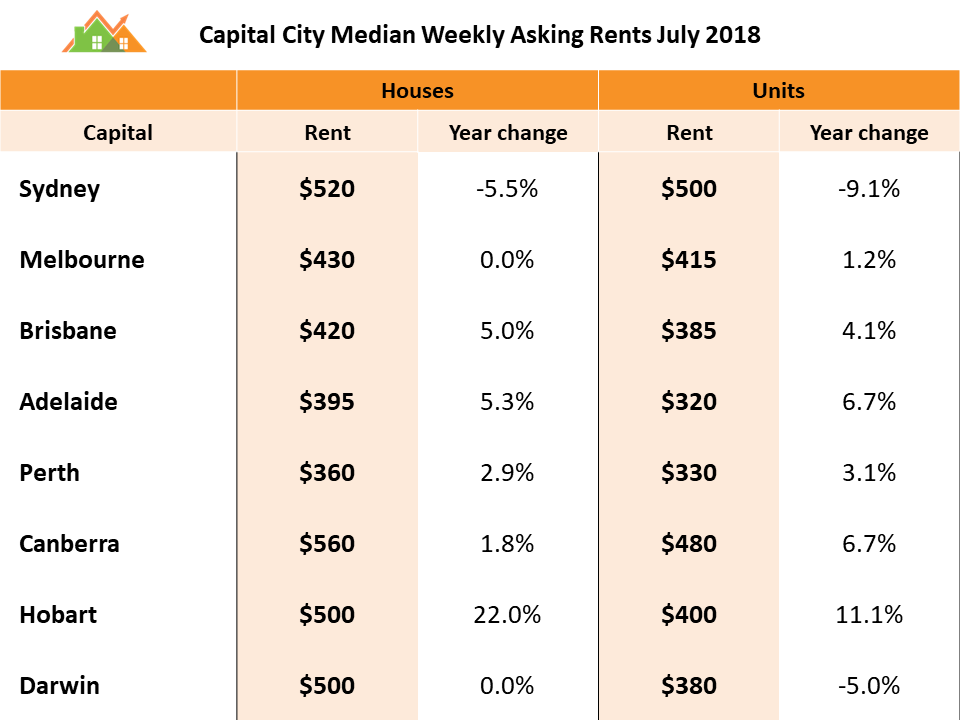

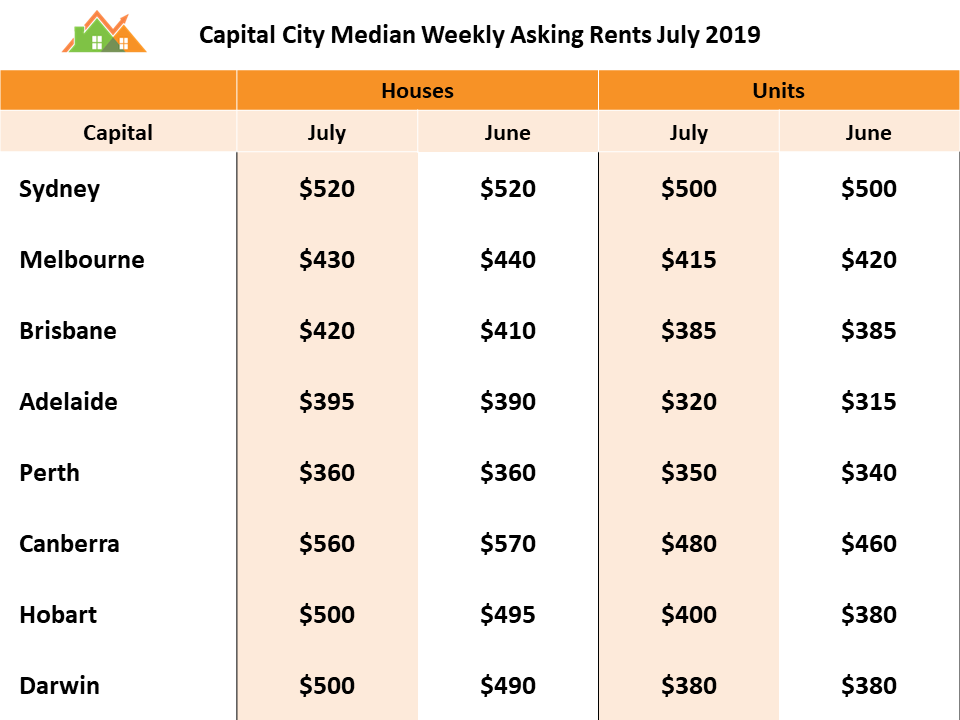

The rental markets

The rental markets have changed very little over the last month, with vacancy rates and asking rentals much the same as last month.

Darwin still has an issue with an oversupply of rental properties and Sydney’s vacancy rate has crept up a little over the last year, particularly because of the oversupply of new apartments.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia's leading experts in wealth creation through property and writes the Property Update blog.

With thanks to PropertyUpdate.com.au and MyHousingMarket.com.au