The old saying “You have to spend money to make money” is especially true when considering this question: should I spend money on an investment property?

As many successful investors will testify, the long-term financial rewards of property investment easily justify the purchase price. However, a related question that’s more debatable is this: should I spend money on a buyer’s agent?

investment are not guaranteed and it just takes a quick glance at the data pages at the back of this magazine to see how right (or wrong) an investor can get it.

It’s also evident that a wide range of factors influence the degree of capital growth a property will experience, and this information

takes some due diligence to acquire.

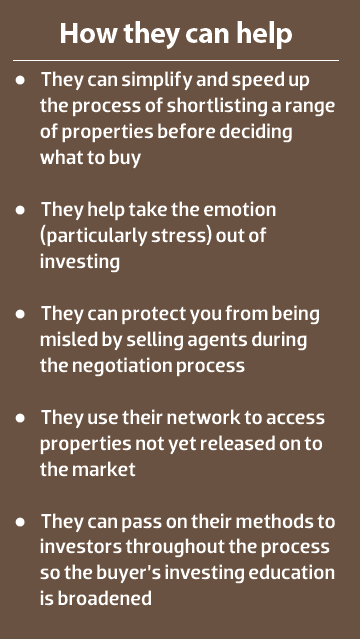

This is where the buyer’s agent (or buyer’s advocate) comes in. One of their key roles is to provide advice to clients on where and

what to buy, says Justin Lilburne, a buyer’s agent for JPP Buyer Advocates.

“Buying the right property for the right price in the right timeframe could save tens of thousands of dollars now and make hundreds of thousands of dollars in 10 years’ time,” says Lilburne.

This is done by firstly understanding the client’s long-term goals and how these can be achieved based on their budget and

timeframe.

In order to do this, it’s paramount that the buyer has an idea about what they want to achieve. For instance, they may be chasing

long-term capital growth or positive cash flow or looking to add value via renovation or subdivision.

“Buying the right property isn’t rocket science; however, many buyers take the plunge without doing their due diligence,” Lilburne

says.

Another key role of the buyer’s agent is their input in the negotiation process. In the immense stress and/or excitement of making an offer, an investor can lose a lot of money, says Miriam Sandkuhler, a buyer’s agent for Property Mavens.

“When people are under pressure and highly emotional they tend to lose control and overpay for property,” she says.

In particular, using an experienced buyer’s agent will protect you from being misled by the selling agents who underquote, and in a hot market it can mean the difference between buying a property and continually missing out, says Sandkuhler.

WHO THEY CAN HELP

For people who are new to investing, using a buyer’s agent can be a great way to learn the basics of the process.

“We provide a written report for each property which we go after,” says Lilburne. “This is to act as a guide and allows our clients to make an informed decision based upon realistic and real-time data.”

Indeed, many experienced investors today look back on the first property they bought and know they could have done better if they’d had the right help. Whether it’s buying in the wrong area or paying too much money, buyers’ agents can help buyers eliminate those rookie mistakes.

Additionally, a buyer’s agent can help anyone who is short on time or confused about the market and conflicting advice from selling agents, developers and property spruikers, says Sandkuhler.

“They are frequently time-poor professionals who need somebody else to secure them a result, or they are anxious and don’t know where to look or what to buy. They are also overwhelmed by conflicting information in the marketplace,” she says.

Lilburne agrees, stating that the three main reasons to use a buyer’s agent are lack of time, lack of knowledge and/or lack of understanding about the negotiation process.

Another important point is that some buyers’ agents offer a service where they are only involved in the negotiation or auction bidding. In other words, the buyer finds the property, while the buyer’s agent makes sure they pay the lowest possible price.

The other category of service is typically the full search and acquisition service. With this service they search, inspect, evaluate and negotiate the right property for your needs.

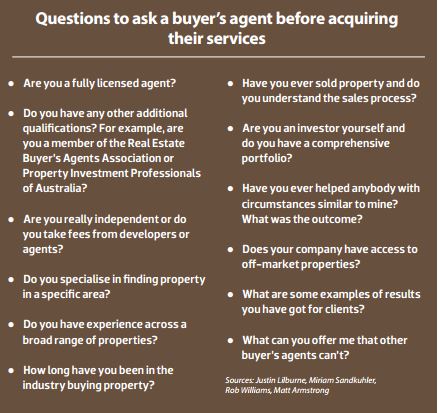

HOW TO SPOT THE RIGHT BUYER’S AGENT

The first step towards finding the right buyer’s agent is to realise that there are different types of buyers’ agents and some suit investors more than others.

For example, some buyers’ agents are generalists, while others have a niche expertise and might specialise in working with investors or homebuyers, says Sandkuhler.

This is important because investors require an analytical process since the numbers must stack up if they are going to make a healthy profit. On the other hand, homebuyers require an emotional process since the home must meet their personal needs.

Ultimately, it is wise to look for somebody who is fully licensed and has the relevant qualifications and at least 10 years’ experience of being a buyer’s agent, says Lilburne.

You should also look to see if they charge a set fee, he says. This is important because if they charge a percentage of the final purchase price this might actually provide an incentive for the buyer’s agent to not negotiate the lowest possible price.

THE DOWNSIDE OF BUYERS’ AGENTS

There are some important things to watch out for when acquiring the services of a buyer’s agent.

A lot of buyers’ agents are actually former selling agents, so just because they know how to transact in real estate doesn’t mean they have investment expertise, says Sandkuhler.

“Selling property or buying property doesn’t make you an investment expert; it just means that you might know pricing or you might know the negotiation process,” she says.

“However, it doesn’t mean you necessarily have a skill set to understand and distinguish what makes one property perform better than another.”

They might also be property spruikers or project marketers masquerading as buyers’ agents and charging a ‘membership fee’ but actually earning a commission from a developer.

These people are definitely not buyers’ agents and neither are those who ‘find’ you property by searching their database of development stock, but earn their fee from the vendor, Sandkuhler says.

Other people to watch out for are the following:

● Those who aren’t licensed estate agents or agents’ representatives in their state and registered with the Business Licensing Authority or Fair Trade, yet call themselves buyers’ agents and illegally charge for this service.

● Those who are very ‘salesy’ in their property recommendations and attempt to turn over clients quickly.

● Those who think or act more like a selling agent than a buyer’s agent; for example, they don’t negotiate contract clauses in the buyer’s favour as part of the transaction.

● Those who are not a ‘sole focus’ buyer’s agency because they also sell new and off-the-plan property or group/block developments. This means they don’t truly focus on the buyers 100% of the time and will try to find you the easier deal of a property they want to sell. They will coach their clients to ‘overpay’ for property, in order to secure an outcome.

Unfortunately, many of these people purporting to be buyers’ agents are in a prime position to take advantage of exactly the type of people who often use the service – that is, those who are beginner investors or busy investors. That’s because both these groups often don’t have the knowledge or the time to properly scrutinise the self-described professional who is charging them a fee.

Finally, the buyer’s agent fee can be expensive for investors on tight budgets, particularly as it comes on top of the sum they are paying for the property (and all its additional expenses). And if you are planning on building your portfolio quickly, this fee must be paid again and again, which can really add up.

This is why some beginner investors prefer to pay to be educated, which can be a one-off fee that covers multiple aspects of property investing, including research, tax, finance, etc.

Case study 1

HOW MUCH THEY COST

Many buyers’ agents charge fees based on a percentage of the purchase price; however, they will often lock in a fixed price for your search so that there is no incentive for a higher price, according to the Real Estate Buyer’s Agents Association of Australia (REBAA).

For instance, if the buyer is looking to spend between $1m and $1.5m they may fix the fee regardless of whether it costs $1m, $1.5m or somewhere in between.

However, as a very general guide, the buyer’s agent’s full-service fees work out to be typically 1.5–2% plus GST of the purchase price, says the REBAA. This is a similar figure to what most real estate agents charge for selling a property.

Additionally, many buyers’ agents will ask for a proportion of their total fee to be paid when signing the contract.

Some operate as a buying club where they go to find a good deal, get it for a discount and offlad it to a group of investors. The idea is to buy in bulk so they can get a discount. They then charge the investors who take part in the deal a fixed amount, generally around $10,000.

It is also worth mentioning that when purchasing an investment property the buyer’s agent’s cost is normally tax deductible.

HOW A BUYER’S AGENT NEGOTIATES

Sandkuhler offers her tips for acquiring your desired property and getting the lowest possible price.

Always put the figure in writing

To throw a figure at an agent verbally means there is no evidence of the offer. However, agents are legally required to present all offers to vendors. If you document the offer, even if it is via an email or a text message, there is evidence of an offer having been presented. This compels the agent to present it to their vendor.

Never reveal the reasons you are buying

Don’t get overly excited about the property or give an indication that you have an emotional attachment to buying it. You will be manipulated and played emotionally to create fear around you missing out so they can attempt to drive up the price.

Work on the basis of reality

There is always another property that will come on to the market. If you ever feel rushed or unprepared, my recommendation is to not act at all. Just miss out on the property and go find another one. You should have no emotional attachment if it’s an investment property, and if you do you are buying it for the wrong reasons.

Always have the contract checked before you sign anything

Too many people buy at auction without having the contract reviewed or looked at. They have no idea what the obligations are in that contract, and frequently issues present themselves and it’s too late to do anything about it. A lot of contracts are actually wrong. I frequently come across contracts when I am negotiating terms before an auction and there are bits in the contract that are missing.

One investor who’s had his fair share of experience of dealing with a buyer’s agent is Matt Armstrong, Your Investment Property’s Investor of the Year for 2014.

After buying his first property in Caulfield South, Victoria, without a buyer’s agent, he bought his next four properties using one.

The reason why he started using an agent after that first property was that his circumstances had changed.

“When I bought that first one I was single, didn’t have any commitments and had lots of free time,” he says.

“When I was buying my other investment properties I was married, and as a family we did not have time to do the legwork and spend our weekends travelling around and looking at different properties.”

Armstrong found his particular buyer’s agent through a friend’s recommendation. “I have been using the same buyer’s advocate for years now and it takes a lot of the guesswork out,” he says.

“And with one of the purchases I was able to buy it before it hit the market and therefore was able to secure it at a good price.”

He argues that it’s very important to find a buyer’s agent who you can get along with. This is necessary because you may be spending time with them discussing options and going out with them to check the properties they recommend.

“Also, pick their brains to see if they have a different opinion to you on what makes a good property,” he says.

“Then listen to them and find out why, and then use that to extend your own knowledge.”

Armstrong strongly believes buyers’ agents are a great idea for investors and already recommends the service to friends and family.

Case study 2

Rob Williams is a successful investor who has never used a buyer’s agent. He tells Your Investment Property why he has never found it necessary.

Why did you feel confident enough to make your purchasing decisions without the help of a buyer’s agent?

I bought my first investment property in 2001 for $70,000 and it is now worth $350,000, a 400% gain or a compound annual growth rate of 12%. My first property was a two-bedroom unit in a small group of six in the leafy, blue-chip Adelaide suburb of Leabrook. Between 2007 and now I’ve bought seven more, all of which have been very sound investments.

The investment criteria I applied to that first property have served me well since then, so I’ve not felt the need to engage the services of a buyer’s agent.

How did you build your education without the use of a buyer’s agent?

Reading. Lots and lots of reading and research. Magazines are great to learn how professional investors think and operate in terms of decision-making for maximum return while managing risks.

Investment is very much about mindset, and if you learn how other professional investors think and behave, you’re in with a good chance of being able to achieve the same level of success.

In particular, I read about how experts identify high-growth areas in which to invest. That's how I came up with my own checklist or criteria – no more than 7km from the CBD; good transport links to the city; sought-after school district; evidence of money fl owing into (not out of) the area (always follow the money!); and a strong, long-term track record of capital growth. I'm not a 'hotspot' chaser.

Do you feel that a buyer’s agent could have been useful in helping you find the right deals and negotiating prices?

No. I’ve bought a number of properties off-market. In other words, I’ve had vendors come to me and ask me to do a deal with them because they’ve seen how I do business and haven’t wanted to take their properties to market or deal with real estate agents.

Is not using a buyer’s agent something you would recommend to investors?

When it comes to buyers’ agents or any other commission-based or fee-for-service professional, I would recommend proceeding with caution and thoroughly checking the credentials and references as part of the due diligence process.

I certainly would recommend that a novice investor at least explore the possibility of using a buyer’s agent and see what they have to offer in terms of expertise and recommendations. It would be prudent to begin any investment journey by exploring all of the available options and seeking advice from a diverse range of sources.

I know a number of developers who use buyers’ agents to sell their developments directly to investors for generous commissions rather than selling them through real estate agents in the traditional way. If I were an investor, I’d like to know about that relationship and the commissions up front before proceeding.

At the end of the day, the buyer’s agent has to put food on the table. It’s just a question of who is going to pay for that and does the deal necessarily mean it’s the best deal for the investor, the vendor or the buyer’s agent.

The nitty-gritty of life as a buyer’s agent

Cate Bakos of Cate Bakos Property dispels the misconceptions and reveals what life is really like as a buyer’s agent

Some people see the life of a buyer’s agent as glitz and glam. A bit of schmoozing with agents, a bit of inspecting premium water-frontage palaces, and a bit of exciting banter at the time of negotiating. It is far more than that. Buyer nerves, psychological factors, high pressure, competitive buyer activity and an immense amount of due diligence overrides any sense of carefree excitement.

A day of the week might start with a client saying: “Cate, I saw this property and I love it. Can you help us secure it?”

I can respond in one of two ways: I can check it out, tell the prospective client it’s a dud and move on, or I can field the call, look it up on the search engine, call the agent and make the decision to pursue it. Both phone calls take a minute, but one will be a green light, and one will be a red light. So what is it that determines a green light?

IS THE PROPERTY OVERPRICED?

The first pass is the easiest step. Sometimes clients call me about a property which seems too good to be true. It usually is. It’s either zoned badly, has the wrong title, is situated on a main road/train line, or more often than not is so underquoted that they’ve been sucked into the vortex of agent underquoting and they feel that they may have a strong chance at a property which is clearly out of their price range.

Our role is not just to protect our prospective clients but to ensure that they don’t spend money on due diligence for a property that is never going to be in their desired price range.

I tell all of my clients when they engage me: “Don’t hold back from calling me on the weekend when you walk through a property which you love.” The reason I do this is because I know that I will be able to determine the real likely selling range for this property and guide my client towards a prepare-for-negotiations position, or a move-on-and-findsomething-else position in the event that the property is out of their desired price range or unsuitable.

THE COMPARABLE SALES ANALYSIS

Once we have found a property which potentially makes the grade and fits the price band, we have some intensive and important tasks to manage over a tight timeline.

The first step is to conduct a comparable sales analysis. This step includes a rigorous collation of recently sold properties which have similar land size, style, house size and quality of renovation. Some may be inferior, superior or not even comparable, but those which come close to the subject property must be scrutinised. Everything from buyer sentiment, macro market effects and vendor motivation on each must be taken into account.

What one sales campaign may require can alter from what another recent sale may exhibit. For example, a vendor who hasn’t yet bought will most certainly differ from one who has indeed found their dream home and has a specific and finite date to meet for settlement. The difference between the two in terms of commercial value can often be anything up to $100,000.

LOOKING CLOSER

Once a prospective buyer has an idea of the value which a property is appraised at, the next round of due diligence includes building inspection, legal review of contract, any future adverse planning effects, and local neighbourhood evaluations. We like to visit the property and the street. A great property is one thing to note, but good neighbours can make the difference between a happy tenant and a constantly revolving front door.

A rental appraisal is always conducted, and just to ensure that we are on the right page, an independent rental appraisal via a local managing agent is a must.

The building inspection fields all of the elements which we could miss. By this stage, our due diligence is down to working with trusted professionals who will advise our clients whether the presence of asbestos threatens their investment, or whether the need for restumping, rewiring or re-roofing can undermine any gain they were depending on with their renovation project.

I often tell my clients that a building inspection is not necessarily an exercise conducted to rule out whether you pursue the property or not, but an exercise to give you good insight into the future expenses that this property is likely to present to you.

The legal review is my must-have. I will not secure a property for a client without the legal review. Often the clauses or conditions are placing the buyer in a position of disadvantage, and this is a position that as a buyer’s advocate I don’t like. I will challenge any agent or vendor’s solicitor and often I will successfully overturn a nasty condition in a contract of sale. The implication is that my buyer doesn’t have to take unnecessary risks or agree to purchase terms which are unfair to the buyer.

It is surprising just how many buyers have signed a contract which they haven’t had reviewed by a legal professional on their side.

A quick check with local planning will ensure that neighbouring properties are not immediately threatening the happiness of my buyer, but obviously the key element to take into consideration on this front is that planning approvals can change on a daily basis. We can only deliver a snapshot of what is submitted to council at that particular time. We do focus on development activity in any given area though, and are mindful of precedent cases in every neighbourhood.

FIGHTING YOUR EMOTIONS

Once we have identified and recommended a property, it doesn’t just stop there. Our clients are almost always emotional about the purchase, and we need to prepare them for all that a purchase entails, from excitement to buyer remorse. It happens to the best of us, and buyer remorse can derail the best of purchases.

I find that preparing the buyer for this deluge of doubt and fear is the best method. We remain on call for all of our clients and we are always ready to deal with nerves and fear. After all, fear is what stops so many could-be investors from making the bold move.

Sometimes the life of an advocate can seem exciting and uplifting, but more often than not it’s a hard slog, a fight with predetermined and unrealistic ideals, and a challenge of high emotion or buyer remorse. I often feel like a psychologist, but that’s OK. It’s an exciting world which is largely fuelled by psychology, so why not face it head-on?