How is the market going?

It is probably the question I am asked most, sometimes many times each day.

Specifically referring to the Brisbane market, as I have been buying for our clients here for over a decade and investing for myself for close to two decades.

In my position, there is one thing I can offer that the media and many theorists cannot – an on the ground perspective.

And I can assure you, what is making headlines in the media currently, is not playing out at ground level – in the right locations.

Let me explain what I mean when I say the “right locations” or talk about “Brisbane” in general.

Brisbane

When I say Brisbane, I am talking about select suburbs within 10km from the Brisbane CBD.

Suburbs where there is significantly higher demand due to employment, public transport, superior schooling and education, along with greenspace and lifestyle precincts.

And on the flip side, there is very, very tight supply, with next to no new land available anywhere.

Interestingly, unlike our bigger City cousins, you can expect a vastly different environment buying just 15km or 20km out.

I am constantly amazed when interstate buyers and the FIFO buyers’ agents target fringe suburbs in highly inferior locations, expecting a similar result to a Sydney or Melbourne.

To highlight this point, REA produce a great graphic comparing the level of demand for a Suburb vs. the Average for QLD.

I have chosen two suburbs in Brisbane, being Camp Hill (approx. 5km from the CBD) and Mansfield (approx. 10km from the CBD).

The levels of demand currently in these locations are quite extraordinary and close to three times the average for QLD.

Here is what I am seeing and expecting to happen in these superior locations…

It is a vastly different story when you start moving further out where I selected three suburbs that I know our competitors are quite fond of, Zillmere (15km), Redcliffe (25km) and Pimpama (50km).

These suburbs are well below the averages and do not meet all the strict investment criteria we look for in investment grade suburbs.

These are the suburbs at risk moving forward as job security is inferior and people are living week to week.

The current market

The latest numbers from Corelogic show our capital cities remaining relatively unchanged, specifically over the last quarter to 19th June 2020.

If anything, Brisbane has held up slightly better than Sydney and Melbourne, likely due to more modest growth over the last 12 months.

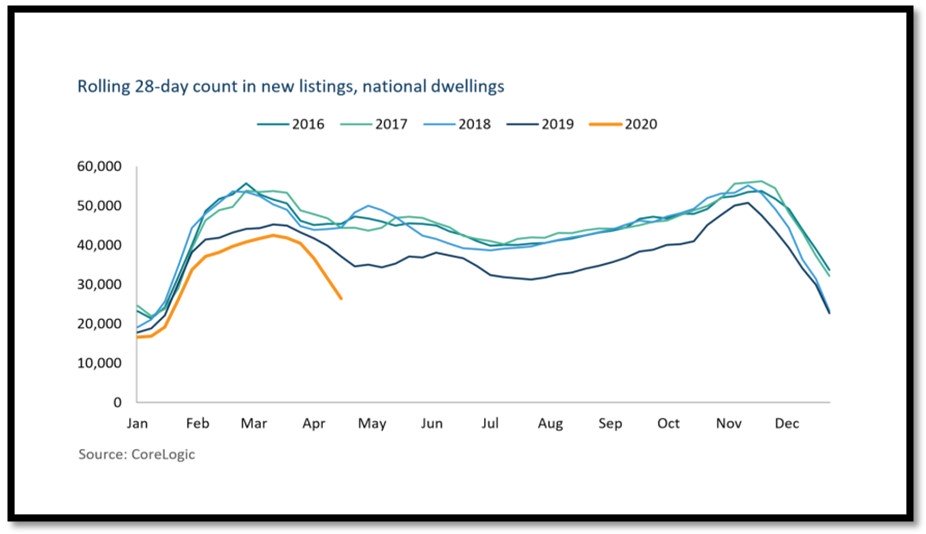

I would suggest that this would be easy to explain in the sense that yes there are less buyers in the market due to COVID-19, but there is also less sellers.

Stock levels are well down on this time over the last 4 years.

It appears buyer and seller numbers may have effectively cancelled each other out and there remains a form of equilibrium as we round out the financial year.

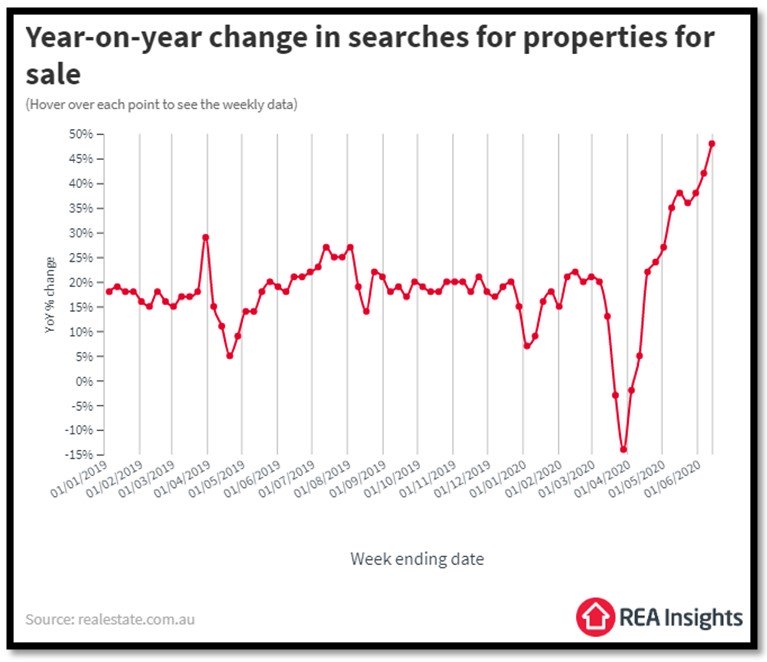

Another very interesting set of numbers recently, has been a change in the number of searches online for property.

Sure, with more people at home scrolling through real estate you could expect that, but almost a 45% increase on the same time last year represents a clear trend – upward!

This trend is also playing out on ground level with many local agents reporting much stronger numbers through open homes here in Brisbane.

I know we have also missed out on the odd property due to the odd home buyer willing to pay that little bit over where we see value.

So, there is still buyer emotion in the market and no sign of a bargain as many had predicted.

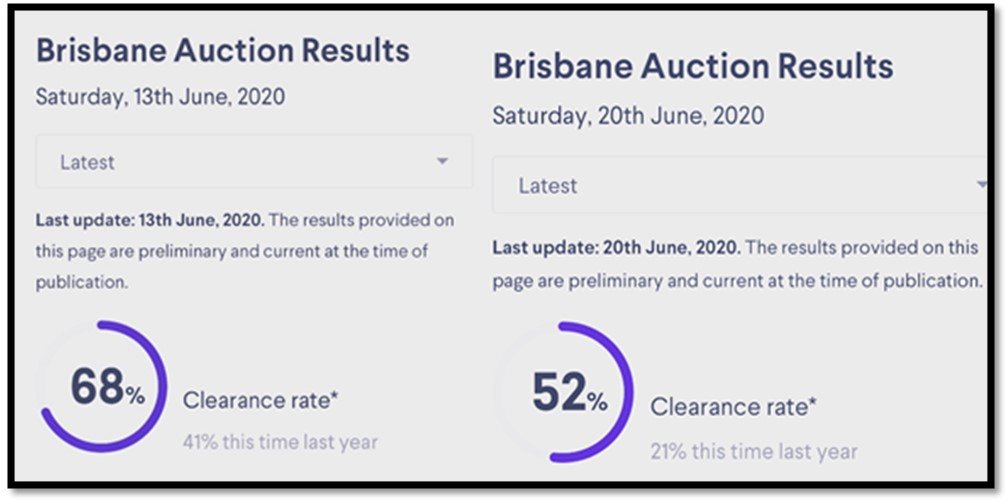

Another strong set of numbers in recent weeks have been the rise in Auction clearance rates for Brisbane.

These numbers are published by Domain each week and usually hover consistently between 20% – 40% on an average weekend in Brisbane.

They are now up around 50% – 60% plus and well above this time last year in a pre COVID-19 market.

More headwinds

There is no doubt that there are several strong headwinds still in our faces, particularly once we hit September.

It may see the end of the Job Keeper and Job Seeker payments and more people will very likely face the unemployment line.

Unemployment is tipped to hit more than 10% over the next few months.

We also face a great deal less immigration and overseas visitors during this time.

Many are also predicting the end of the honeymoon from banks for mortgage and investment loan payments may also create serious issues.

And the list could go on and on…

I have no doubt there will be impacts on the overall property market, but here is why I am optimistic about…

Investment grade locations in Brisbane

Starting on a Macro Level, with the Federal and State Government incentives.

The current Job Seeker / Keeper payments are support mechanisms, the stimulus is starting to arrive and in almost all previous downturns housing is a target.

From First Home Buyer Grants, to Construction incentives and even talks about abolishing stamp duty has been on the cards.

Whatever may happen moving forward, all forms of Government will make this a priority as they always have.

In the next few months there is no doubt that the unemployment rate will rise and so too will mortgage stress.

It will happen in all suburbs, but significantly less in these superior locations, close to employment hubs where the types of jobs have been less effected.

In superior suburbs there tends to be dramatically less unemployment and less mortgage stress, on the other hand as you may further away from major employment hubs, unemployment and mortgage stress rises.

Now you can see that even if Demand dropped in suburbs like Camp Hill and Mansfield by up to 30% or 40% there is enough to keep demand quite high, while the other suburbs may have some serious issues.

Jobs to the rescue

I have written previously about the current transformation of Brisbane, with more than 50,000 jobs expected between the CBD and Airport.

This will be the saviour for Brisbane over the medium term.

I often here that an outer suburb has a new rail line, or university or hospital that will create a few hundred jobs.

This is barely a drop in the ocean compared to the next few years in Brisbane.

In conclusion

With less buyers and less sellers in the market currently, property prices have remained stagnant.

However there are some serious headwinds on the horizon in the form of unemployment and other challenges for buisnesses and employees as the mortgage free period comes to an end around the same time

I have no doubt that that there will be some serious issues for certain types of property in the wrong location.

The dramatic forecasts may well yet prove correct, but I remain very opimistic about the Brisbane market over this period.

In superior locations, more people are lucky enough to have not been efffected as much by the current financial environment and will likely get through the next hurdle relatively unscathed.

They are predminanlty home buyers – driven by cheap interest rates and combined with solid employment grounding are taking a longer term approach.

They have the ability to buy in superior locations close to work and ammenities as demand continues to remain high.

For others looking for employment, there is a jobs boom starting to ramp up across the Brisbane CBD and out to the Airport.

So demand for housing will continue to remain high within that 10km ring.

.....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.