Would you like to understand the key factors that drive our property markets?

These key drivers can be critical when selecting the right asset to fast track your wealth creation journey.

Considering the current environment, I would argue, it is even more important now than ever, as we head into an environment of low economic growth.

Following a proven path and strategy during these times is also essential.

Many will chase the latest fad in order to boost cashflow as they attempt to improve their short-term situation.

But the truly wealth continue to build their asset base by targeting capital growth.

They understand that cashflow keeps you in the game, but it is capital growth that helps you exit.

Here are my thoughts:

1. Household formation

There is no doubt that population growth is a factor that drives demand for property, resulting in capital growth.

But by digging a little deeper it is even more important to understand Household Formation.

Population Growth may be the big picture, but it is more important to understand how many new households we are forming.

For example, when a family has a new child they make take up an extra bedroom, but there is not a requirement for a new home.

So, by understanding the number of new homes that will be required to be formed as a result of population growth, you will get a much better idea of demand.

You will find most of the demand for new households are in the inner – middle ring suburbs close to employment hubs and lifestyle amenities.

2. Housing supply

While we continue to see strong demand for new households, the other side of the ledger is supply.

Currently, there has been an undersupply looming around the country.

Clearly this will be different from state to state on a macro level and even suburb to suburb on a micro scale.

I know some parts of outer Melbourne and Brisbane where there is another 10 years of land supply left.

We avoid these areas.

We look for suburbs that are critically undersupplied, where there is no ability for new land or large-scale housing estates.

3. Interest rates

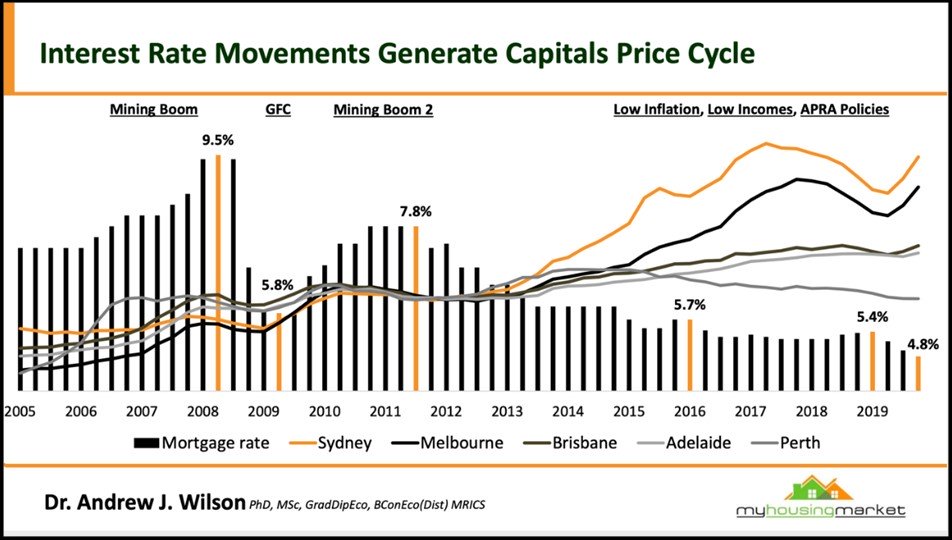

Interest Rates and the cost of money is also a key driver.

It makes sense, right?… the cheaper money, the more you could potentially borrow and / or the less you will repay.

I believe this key factor is keeping our markets strong during this difficult time of uncertainty and lockdowns.

More specifically, it is home buyers with reliable jobs and a steady income that are seeing this as an opportunity.

A decade ago we saw interest rates in the high 7%’s now, Home Owners have access to rates circa 2%.

The chart below from Dr Andrew Wilson shows the clear relationship between interest rates and house price growth.

4. Local factors

There is not one Australian property market, as there is not just one Sydney, Melbourne or Brisbane property market.

There is no better example currently, as we have Melbourne in Lockdown 2.0 and virtually no property activity, while Sydney and Brisbane remain open for business.

Economic factors will play a big part, but I feel a significant driver is employment and jobs growth.

Brisbane is a great example of this, with a rather benign property market over the last decade due to a lack of jobs growth.

With more than 50,000+ jobs between the CBD and Airport, our population has started to grow again, causing demand for homes in superior locations.

Another key factor over this period of low growth will be Wages Growth.

While the majority will face no to low wages growth, there is a small group of people with the right type of jobs and multiple streams of income that will continue to push up property prices.

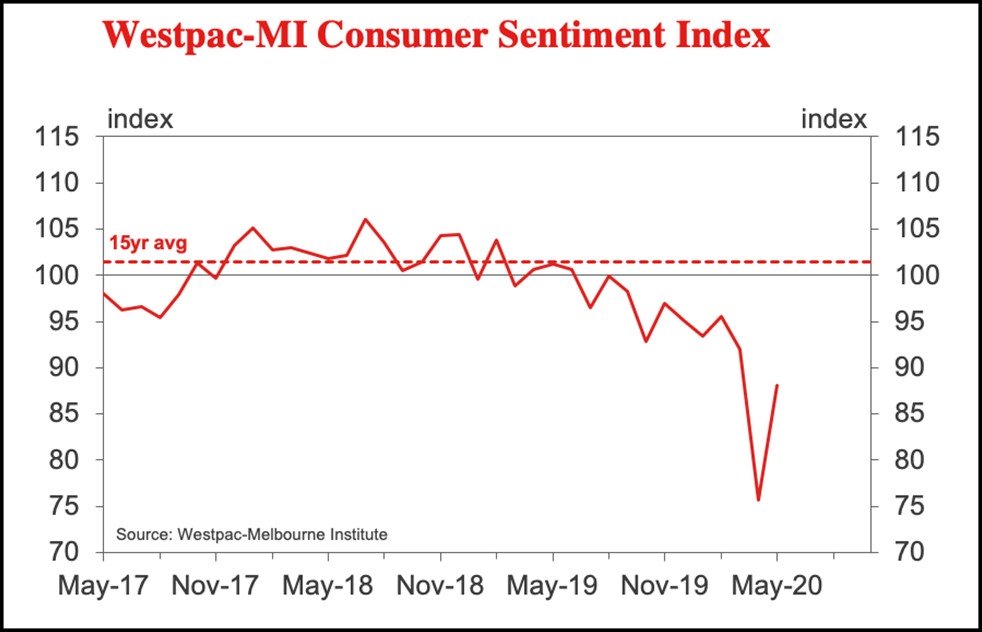

5. Consumer / Market Sentiment

There is no doubt our outlook on life will impact on our decisions.

So, it is not a surprise to see market sentiment take a nosedive in the early parts of 2020.

We have never seen anything like it previously, with a simple virus shutting down the world, combined with an incredible amount of political and social unrest.

People are less likely to commit to big decisions while there are so many issues on a global scale.

On top of that, there may be additional layers at home with their employment potentially in question or other financial hurdles.

Although we appear to be heading in the right direction, there may be more to play out here.

In summary

While there are a large number of factors that drive our property market, I have narrowed it down to just 5 key factors.

Factoring in the demand for new homes over population growth, will be the key to understanding the demand side.

While digging down and understanding what housing will available will assist with the supply side of things.

Interest Rates and the cost of money will always play a factor and with record low rates there is no surprise to see home owners keeping our market stable.

There is not one Australian property market, so understanding key local factors like employment and economic issues is critical.

Finally, it is no surprise to see consumer confidence take a nosedive due to recent events.

As people start to feel more certain their confidence will return to make bigger life decisions.

While many will wait this out, the successful will keep moving forward.

Not necessarily by taking action….. yet, but by planning, preparing and understanding these fundamentals so they can take action when the time is right.

.....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.