Homebuyers and investors who focus solely on the median dwelling price are missing out, as it’s the price per square metre that remains one of the key factors tied to risk and return.

In our analysis, price per square metre (PSM) data is one of the key criteria we look for when reviewing property trends.

Why? Because, put simply, PSM reveals the ‘true’ value of the property. As a result, it is a very effective tool to identify opportunities and anomalies in the market, helping investors to better assess the risks associated with suburbs and individual properties (particularly units).

Through our extensive research, we’ve been able to identify prime opportunities by leveraging PSM data as follows.

First, we identify areas (e.g. Eastern Suburbs, North Shore) with a high price per square metre. Based on our research, these areas carry a lower level of risk and deliver, overall, a stronger capital growth over the long-term, particularly for houses.

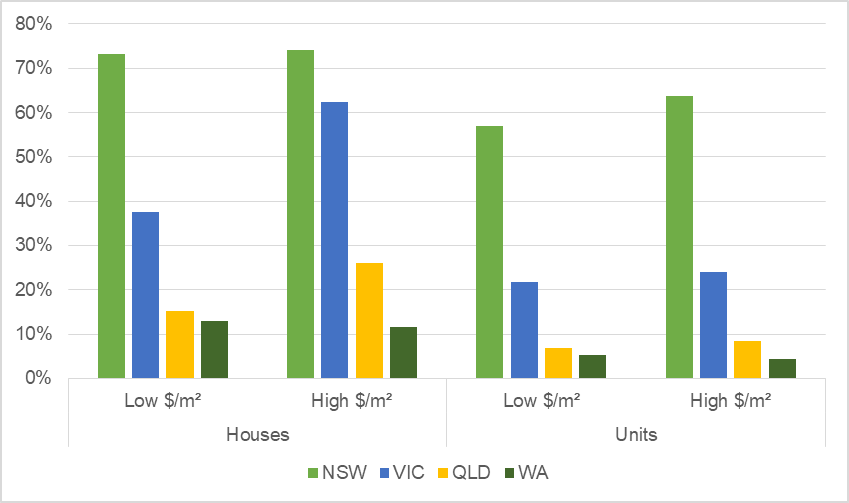

Price growth over 5 years

Our next step is to identify suburbs within these established areas, where the price per square metre is low compared to the surrounding suburbs. This reduces your equity risk and increases the likelihood for a solid capital growth.

Note that this data is very different from median price data, as unit sizes (and therefore values) can vary greatly within the same area.

Investors who successfully identified such opportunities five years ago, today own property that have significantly outperformed the market. A prime example is a unit in Freshwater; with a price PSM of $7,516, it was significantly cheaper than the nearby Curl-Curl, with a price PSM of $10,000. As a result, property prices in Freshwater have increased by 63.5% in comparison to 47.5% in Curl-Curl.

Another good example is a unit in Vaucluse – and investment that is often overlooked by eastern suburbs buyers, who favour the beachside areas of North Bondi and Bondi Beach. Five years ago, the price per square metre in Vaucluse was $6,596, significantly cheaper than in these trendy suburbs. The price of a relatively large three bedrooms in Vaucluse was similar to the price of a large two-bedroom unit in neighboring suburbs.

Moving forward half a decade, the capital growth in Vaucluse was 78.2% and a large three bedrooms there is rare as a hen’s teeth. In comparison, in the surrounding areas growth across the same period was around 60%.

Currently, there are a large number of anomalies in the market. A prime example is units in Glebe and Annandale, where the median unit prices are similar with $808,000 and $875,000, respectively, representing a price difference of 7.5%.

However, the price per square meter in Glebe is only $9,280 where the price in Annandale is $12,873 – effectively a 38% price difference.

Another good example is Rose Bay. With a median unit price of $1,065,000, many investors consider that suburb to be on par with Dover Heights and North Bondi, which boast a similar median price. However, the price PSM in Rose Bay is only $11,100, while in Dover Heights and North Bondi it exceeds $13,000 PSM – effectively a 17% price difference.

On the other side of the scale, we have identified Zetland as one of the riskiest suburbs in our 100 Danger Zones Report. Zetland has a very large number of units in the pipeline, and moreover, the price PSM is $11,658 – very expensive, especially when you consider it is around 10% more expensive than the affluent suburb of Double Bay. With this kind of analysis, it becomes clear that PSM data can be an invaluable tool for selecting your next quality property.

RiskWise Property Review’s custom made reports and the Best and Worst Off-The-Plan Areas reports are available at otp.riskwiseproperty.com.au.

.....................................................

Doron Peleg is the CEO/Founder of RiskWise Property Review, a Co-Founder and Managing Partner of 'PELEG, KESSEL & CO' and a former Executive Manager at Westpac.

Doron Peleg is the CEO/Founder of RiskWise Property Review, a Co-Founder and Managing Partner of 'PELEG, KESSEL & CO' and a former Executive Manager at Westpac.

Utilizing 20 years of experience in risk management, Doron has Co-developed RiskWise's property risk rating algorithm. This smart algorithm enables potential property investors to better access and mitigate risks for individual propertues in Australia.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.