New home sale numbers took a dive in the lead up to Christmas last year, with recently released figures showing a significant drop in buying activity.

The HIA – JELD-WEN New Home Sales Report, which is based on a survey of Australia’s 100 largest builders, found that seasonally adjusted new home sales dropped by 4.9% during the month of December.

“The intensification of bad news regarding Europe, question marks over labour market prospects in Australia, and avoidable delay and uncertainty as to whether banks were going to pass on the Reserve Bank’s second rate cut conspired to drive a fall in new housing contracts as the holiday season approached,” said HIA chief economist Harley Dale.

Over the course of the year, new home sales were “essentially flat”, he added, showing a slight increase of 0.2%.

“Meanwhile, building approvals will record a fall for the December quarter and new home loans will likely do the same,” he said. “Leading new housing indicators therefore ended 2011 on a weak note.”

New multi-unit sales saw a big jump in December of 29.4%, but dropped by 15.7% over the quarter. Detached new house sales saw a 7.7% fall in December, but rose by 2.1% over the quarter.

On a state-by-state level, the number of detached new home sales made in December saw a big monthly drop in Queensland (-20.5%), followed by Victoria (-10.5%) and NSW (-4%). Away from the eastern seaboard, detached new home sales increased by 12% in South Australia and 6.8% in WA.

Modest price falls

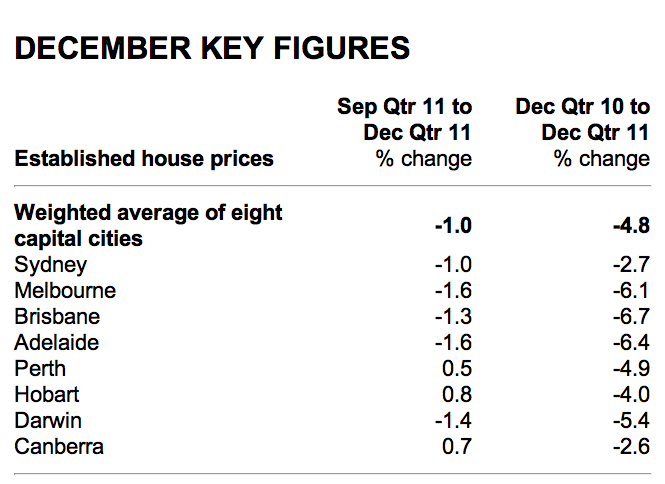

The news comes as ABS quarterly house price results reveal modest house price decreases in five out of eight state capitals over the December quarter. According to ABS figures, the biggest losers were Adelaide and Melbourne (-1.6%), followed by Darwin (-1.4%), Brisbane (-1.3%) and Sydney (-1%).

Hobart (0.8%), Canberra (0.7%) and Perth (0.5%) all saw slight house price increases, according to the ABS, while the average of all eight cities was down 1% over the quarter.

When compared to the results from the December 2010 quarter, all capitals showed a house price drop, with Brisbane (-6.7%), Adelaide (-6.4%) and Melbourne (-6.1%) recording the biggest declines. The average of all eight capital cities was down 4.8% over the year.

Dale, however, is optimistic that the situation will improve in 2012 – and certainly doesn’t subscribe to the doomsayers’ view that Australia is headed for a property market crash.

“Today’s update does bear some resemblance to the annual declines evident in late 2008 and early 2009. There are, of course, enormous variations in house prices within and across cities – and regions – in Australia, but as was the case in 2008/09, the widespread price plunge portended by some for 2011 predictably never emerged,” he said.

“Lower interest rates will feed into an improved environment in 2012, although we won’t see a return to widespread strong house price growth.”

The results:

Source: ABS

Are our capital cities due a comeback this year? Discuss the issue with likeminded property investors and experts on our property investment forum.

More stories:

Sydney, Melbourne rents harbour mixed fortunes