How does $74,000 for a block of land sound? With reports coming in that the land market has reached its lowest point for a decade, the country's cheapest regional land markets have been exposed.

Claiming that the median land value in regional Australia fell by 0.7% cent in the December 2011 quarter to $153,833 – a drop of 1% on the December 2010 quarter – the HIA-RP Data Residential Land Report has revealed the 10 regions where vacant land has hit rock bottom prices.

So which areas make the top 10? South Australia, New South Wales and Victoria take three spots each, with Tasmania completing the list. The cheapest regional land market, according to the report, was the South East region of SA with a median lot price of $74,000. Mersey-Lyell in Tasmania takes the second spot ($77,500), followed by Mallee in Victoria ($80,750). Scroll down to see the top 10.

These figures contrast sharply with those of the top 10 most expensive regional land markets, with Richmond-Tweed (NSW) , the Sunshine Coast (Qld), the Gold coast (Qld) and Illlawarra (NSW) all recording median lot prices of more than $200,000.

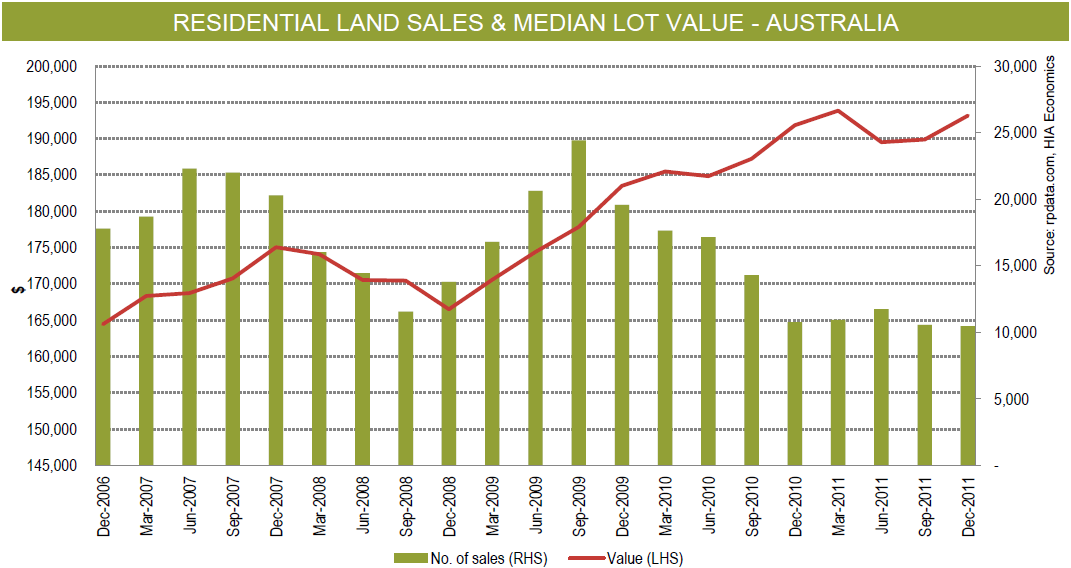

According to the report, the overall volume of residential land sales fell by 27% over the year to the December 2011 quarter. Despite this fall in sales activity, the weighted median residential land value in Australia increased by 1.7% during the quarter to be 0.7% higher than it was during the same period in 2010.

There was a big contrast between the performance of capital cities and regional areas when it came to land values, however, with the median value for capital cities increasing by 2.8% over the quarter to be 1.5% higher than the previous year’s figure. The median residential land value in Regional Australia, meanwhile, saw a quarterly drop of 0.7% - which put it 1% lower than the figure recorded the previous year.

“Vacant land markets are substantially weaker now than what they were back in the height of the GFC and the duration of the downturn has been sustained for five quarters,” said RP Data research director Tim Lawless.

“Over the 2011 calendar year we have seen just under 44,000 land sales which is 46% lower than what was recorded over the 2009 calendar year. Compare that to the dwelling market where transaction volumes are about 28% lower compared with the 2009 highs, which is a weak result in itself, and the significant weakness in the vacant land market becomes even more apparent.”

How do land values affect your property investment decisions? Join the debate on our property investment forum.

More stories:

Show me the money: Australia’s richest and poorest states revealed