It looks as if Australia’s buyer’s market conditions are set to remain for the time being, as the number of properties hitting the market continues to hit record levels. But some cities are faring far better than others, with one major capital seeing its stock levels rise by an incredible 7.6% in one month. Read on to find out where’s hot and where’s not.

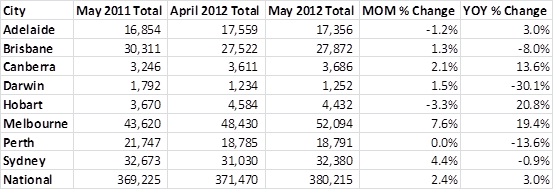

According to recently released figures from SQM Research, the number of properties on the market nationwide hit 380,215 last month – a monthly rise of 2.4%. But some cities only saw marginal rises, while others recorded figures that will seriously worry local property investors.

Melbourne saw the largest increase (7.6%), bringing its year-on-year change to 19.4%. Sydney also saw an above national average monthly rise (4.4%), but its yearly figure remained in negative territory (-0.9%). Hobart (-3.3%) and Adelaide (-1.2%) were the only capitals to record negative monthly figures.

Over the last 12 months, however, Hobart has seen the largest increase in stock levels (20.8%), followed by Melbourne (19.4%) and Canberra (13.6%). Darwin saw the largest annual fall (-30.1%), followed by Perth (-13.6%) and Brisbane (-8%). (Scroll down to see the full results).

Source: SQM Research, May 2012

SQM Research noted that it was previously believed that stock levels may possibly have peaked for this cycle, following recent stabilisation and subtle declines in stock on market figures. But last month’s figures suggest a change in direction – indicating Australia’s residential property listings have not yet peaked.

"Quite clearly the results have been driven by a rapid increase in Melbourne, but we also note the other increases recorded for the majority of the capital cities and so overall, this does raise questions once again on whether stock levels have peaked. And further, at these levels, I can only conclude that house prices are still falling for most capital city locations, as we speak," said SQM Research managing director Louis Christopher.

What do you make of Australia’s market conditions? Is now the time to buy before the market turns? Place your comments below, or join the conversation on our property investment forum.

More stories:

Queensland property expert faces homelessness