Building a successful property portfolio involves getting a solid grip on your cash flow. Scott McCray shows you how

Optimising your property portfolio’s cash flow is all about balance. This is determined by your personal priorities based on your individual circumstances and your plans for your property portfolio.

Your goals might include:

- Holding all properties for the long term while not draining yourself of cash along the way

- Minimising your personal tax

- Keeping the portfolio as close as possible to neutrally geared so you don’t have to start paying tax on the positive cash flow

- Generating income to supplement your personal income

- Maximising your borrowing power to allow you to buy more properties

- Paying off your properties and owning them by retirement

A change in balance and/or your plans might be a result of:

- Interest rates moving

- Rents going up

- Changes to lending criteria

- An interest-only period finishing – this is a major issue to watch out for!

- Needing to upgrade the properties

- Wanting to move and keep the house as an investment property

- Deciding to sell some properties so you can upgrade others or pay them off

The point is, there are no right and wrong strategies – each has its pros and cons – but there are a range of options for you to consider in order to optimise your portfolio and plans.

Your finance game plan

1. Decide how much deposit you will pay

The question here is, is it better to borrow the deposit, stamp duty and purchase costs or use your own cash?

- If your goal is to leverage to gain more tax deductions, a good way to go is to draw out equity from another property as an equity investment loan, to cover the deposit, stamp duty and legal costs.

- This loan is fully tax deductible as it is used for the purpose of investment to buy an investment property.

- You can then borrow the rest of the money as an investment loan secured by the new property.

Let’s say you purchase a new investment property for $500,000 and decide to borrow against an existing property for the deposit, etc.

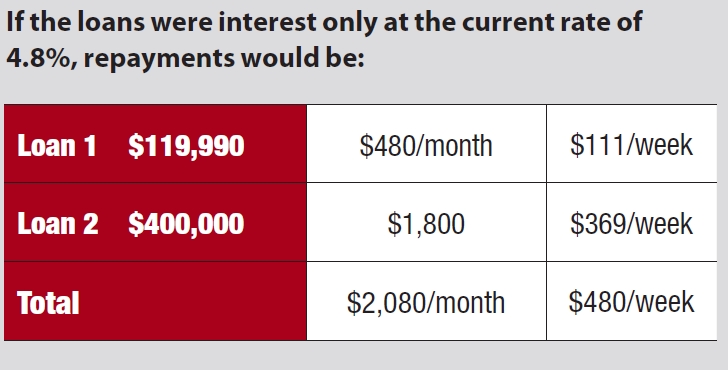

Loan 1

Equity investment loan (secured by the first property) 20% deposit + stamp duty + legal costs and fees $100,000 + $17,990 (in NSW) + $2,000 = $119,990

Loan 2

80% investment loan (secured by the new investment property worth $500,000) 80% x $500,000 = $400,000

Total

Total borrowings of $519,990 = $119,990 + $400,000 The loan to value ratio (LVR) would be 104% = $519,900 / $500,000

Result

- You now have $480 interest per week, which is tax deductible, versus $369 per week if you used cash for the deposit and purchase costs.

- You also have to weigh up the opportunity cost of not being able to use that almost $120,000 for other potential investments.

- However, keep in mind that you will now have a larger debt which it will take you longer to pay off.

Consider the same when upgrading your property. You can borrow the funds to do it, as the loan interest is tax deductible, but you will have a higher debt to pay off over the long term.

2. Decide whether or not to use lenders mortgage insurance

Lenders mortgage insurance (LMI) is required for loans of over 80% LVR. A one-off payment at settlement, it can be added to the loan.

- For an investment property, the cost can be claimed as a tax deduction, amortised over five years.

- It allows you to buy a property with a smaller deposit, instead of having to save for the whole 20% deposit in addition to the stamp duty and purchase costs.

- The cost of LMI varies depending on the lender, the size of the loan and the LVR. The higher the loan size and the higher the LVR, the greater the risk to the bank.

- The cost of LMI increases substantially for loans over 90%.

You are looking to buy an investment property for $500,000.

- At 90% the cost of LMI is approximately 1.89% of the loan value. This equates to a loan of $450,000 at 1.89% = $8,506 LMI.

- At 93% the cost of the LMI is approximately 3.27% of the loan value. This equates to a loan of $465,000 at 3.27% = $15,204 LMI.

This shows why it’s better to keep the LVR at or below 90% if possible.

Many investors like to pay some LMI (with a loan of up to 90%) and keep the remaining 10% in cash for their next investment property, or put it against their home loan to reduce their non-tax-deductible debt.

3. Decide what types of repayments you are going to make

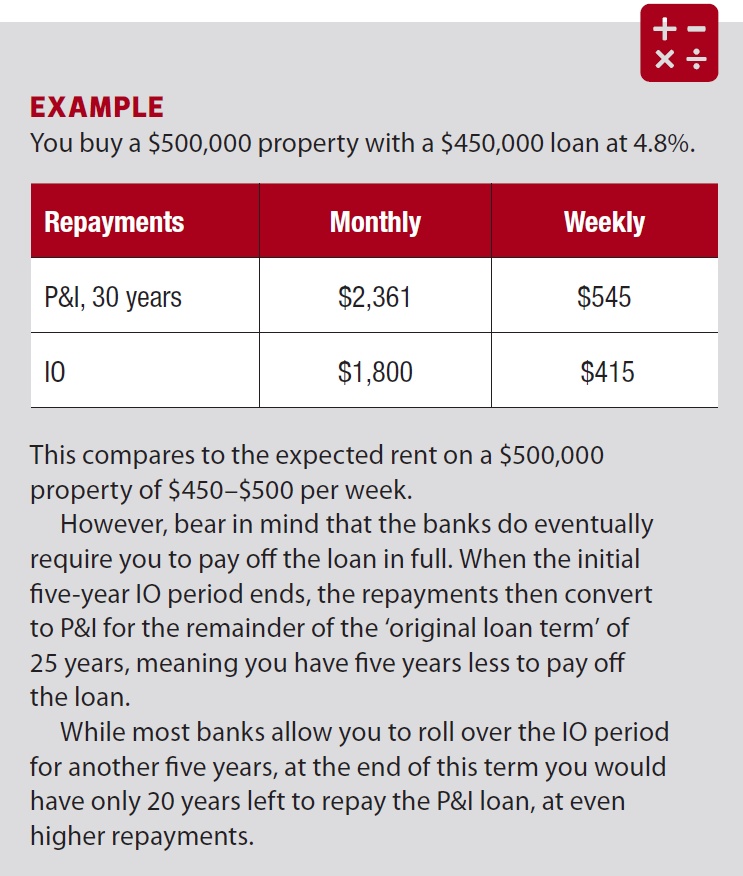

The question here is whether it is better to go with interest only (IO) or principal and interest (P&I)?

- IO loans can have some major benefits for inventors initially, but they do have a major watch-out – once the IO period ends, the repayments convert to higher P&I repayments.

- IO loans reduce your monthly repayments by about 25% initially, which can lower the repayments to below the rent you receive on the property.

Why?

When you apply for an IO loan, you are assessed to see if you have the income to pay off the loan at P&I repayments over 25 years, not 30 years. However, you may have dropped back to only one income, your partner may not be working full-time, you may be self-employed, and you may have children – all of which can lower your borrowing power with the banks.

A strategy often employed by investors involves taking an IO loan for the first five years and putting up the rent every six or 12 months during this time. When they then move to a 25-year P&I loan at the end of the five years, it is hoped that the higher rents will cover the P&I repayments.

Owner-occupiers generally take out a 30-year P&I loan, so they work towards paying off their home loan from day one, as it is non-deductible debt.

Taking out an IO loan on your investment properties gives you more cash to put towards your home loan, paying it off faster.

4. Choose between offset and redraw

It is particularly important to consider whether to use offset or redraw if you live in a property that you plan to hold as an investment in the future, and it’s a major issue to watch out for. Even if this is not your initial plan, often people’s circumstances change and opportunities arise that may mean you decide to move out of your home but keep it as an investment property.

However, this may not be tax-effective unless the right structures have been set up from the start. Often people pay down their home loans as fast as they can by putting extra cash into the home loan account, which lowers the actual loan, while the extra cash is still accessible in a redraw facility.

The issue is that if you convert the property to an investment property, it now has a lower loan balance, reducing your available tax deductions in the future.

If you draw out the equity you have in the property from the redraw to use as a deposit to buy another home, this equity loan is not tax deductible, as the funds drawn would be for personal use to buy your new home, not an investment property.

The rent you receive on your initial property may be considerably higher than the interest you can claim on the loan, which could see you having to pay tax on positive cash flow, on top of your personal income.

As you are using an equity loan from your initial property, plus a new loan, you end up with a combined large loan on your new home loan (non-tax-deductible debt), plus you have to pay tax on the positive cash flow from your first property. In this instance, it may be better to sell the property than keep it as an investment!

If you had set up the loan with a linked offset account and put the extra cash into the offset account, this would have kept the actual loan balance high. So if you did convert it to an investment property, the higher loan would be tax deductible going forward.

You could then use the funds in your offset account as the cash deposit for your new home purchase.

5. Ensure you’re claiming depreciation

A misconception about depreciation on new properties denies owners of older investment properties potentially thousands of dollars in tax deductions each year.

Many people mistakenly believe you can only claim depreciation on new properties, but that’s not the case. Investors can also claim on existing properties; all they need to do is to arrange for a quantity surveyor to create a depreciation schedule for the investment property’s building (depending on when it was built), fixtures and fittings.

Depreciation on an investment property could be $5,000–$10,000 per year of claimable tax deductions.

6. Get your tax deductions back quickly

Getting your tax deductions back on your investment property with each pay packet, instead of having to wait until the end of the year to claim, can make a big difference to managing your cash flow.

This can be done by submitting a PAYG withholding variation application to the ATO, something your accountant can arrange.

Let’s say your accountant estimates the ATO will refund you $5,200 for holding your investment property. The ATO will write to your employer and reduce the tax rate on your pay to equate to $100 per week. The extra cash in your pay packet each week substantially improves your cash flow.

You still submit a full tax return at the end of the year, with any adjustments made then.

7. Be smart with your spending

Be smart with your personal spending and the money you earn, and recognise the true cost of your purchases and the impact this can have on your ongoing cash flow as an investor.

Don’t have bad (high-interest, non-deductible) debt draining you of cash. This includes credit cards, car loans, personal loans, store cards and the like. Instead, put as much money as you can into your offset account linked to your home loan to reduce the non-deductible daily interest charged.

At the current record low interest rates, if you have a $400,000 loan you will end up paying approximately $800,000 in repayments over 30 years. So every $100 you can put into your home loan offset account saves you $200 in repayments.

Then, if your tax rate is 37%, to pay $200 you have to earn $318. So while you have a home loan, if you buy an item for $100 it really costs you $200 and you have to earn $318 to pay for it!

8. Review your rents regularly

Be careful not to just ‘set and forget’ the rents on your investment properties. You should ensure that you capitalise on opportunities to earn the maximum income possible.

Try to edge up the rents every six to 12 months. An extra $20 per week on three properties is $3,120 a year.

9. Maximise your borrowing power

In order to be able to keep buying additional properties, work with your mortgage advisor to understand the serviceability criteria used by the lenders.

All banks have different policies and different serviceability calculators, and it’s important to understand that you’re assessed on the bank’s criteria.

To maximise your borrowing power, you can do the following:

- Maximise your personal income (combined with your partner).

- Maximise the income you earn from your properties by raising rents without losing your tenants.

- Reduce personal monthly liabilities.

- Reduce your credit card limits.

- Refinance and/or fix your rates for your existing loans to secure a better deal.

- Use multiple banks to fund your various properties.

Conclusion

These methods can make the difference to being able to afford more investment properties, or just make it substantially easier to manage the ongoing cash flow juggle. Remember, your ability to hold on to your investment property over the long term is crucial to your success as an investor. Be careful not to just ‘set and forget’ the rents on your investment properties. Try to edge up rents every six to 12 months

Scott McCray is an active property investor and Smartline advisor

This article is from the December issue of Your Investment Property Magazine. Purchase the issue to read more.