11/04/2018

Death and the inevitable flow-on effects – whether socially, emotionally or financially – on family and friends can be so significant that we often dare not even broach the topic.

But, in doing so, we fail to put in place proper contingency plans that would help our families.

In my practice, I have seen so many unfortunate situations following the death of a person that could have been avoidedhad proper asset protection and estate planning measures been implemented.

Once I saw the estate of an elderly mother handed over to her only child who, before the mother’s death, had been declared bankrupt. That meant the estate was given lock, stock and barrel to the child’s creditors.

Another time, the children of a first marriage entirely missed out on receiving anything when their father, who had married a second time, died and his entire estate was inadvertently given to his second wife.

On both occasions, a fairer outcome could have been planned, prepared for and implemented, but it wasn’t. So what should you do?

By failing to plan financially for death, families can be burdened with avoidable problems, such as assets falling into the wrong hands, estates being unfairly distributed, and unnecessary taxes and duties having to be paid.

How can you avoid this, and how do you protect your assets? First of all, you should speak to your loved ones and come up with a wish list (called an estate plan). This should outline exactly what should happen if something unfortunate were to happen, as it sets out how your affairs would be handled.

Secondly, consult qualified advisors. You should assemble a professional team, including a lawyer, a tax accountant and a financial planner. Set up a meeting with all of them, at the same time if possible.

Tell them how you want your assets to be distributed, and ask them to tell you the best way to achieve that. Also, tell them to advise you of the pitfalls of doing things the way you want, and ask them if there are better alternatives.

Thirdly, have your professional team prepare a formal will for you. Sometimes it is preferable to organise asset transfers and set up a tailored structure while the individual is still alive. Your team will help you prepare further legal documents to facilitate a particular structure, if appropriate.

If you already have a professional team but you don’t feel comfortable that they are the right fit, don’t hesitate to make the necessary changes. You may have limited opportunities to get this right. Once you are confident that you have the right team in place, get your professional team to perform a complete legal and accounting health check. They can help you work out: When are your assets at risk? If something were to happen to you tomorrow, what would happen to those assets?

Watch the video interview now:-

"I have seen so many unfortunate situations … that could have been avoided with proper asset protection and estate planning"

What about your debts, loans and credit cards? How would they be paid, or in the case of long-term loans, how would they continue to be serviced? And are your assets set up in such a way that they can be transferred where you want them to go?

When are my assets at risk?

When you are preparing your estate plan, one of the most important criteria to look for is whether your assets will be exposed when they are distributed. Above, we looked at the example of a mother giving away her entire estate to her bankrupted child.

In doing so, she unwittingly put her estate into the line of fire of the creditors, and the child’s bankruptcy trustee took possession of the assets to satisfy the creditors of the bankrupt estate.

Another common problem arises when an estate is given to a spendthrift child or to one who has a form of addiction. In either of these situations, the estate assets can very quickly dissipate.

The last thing a parent will want is for the inherited assets to be lost in this way, and there are planning tools that can reduce the risks of this occurring. When allocating an estate, there are numerous other considerations to keep in mind, and this is where your professional team will step in.

For example, if a parent has children or dependants but the estate assets are not allocated in a way that the children perceive to be fair, the entire distribution can be open to challenge. This area of dispute is becoming all too common. And unfortunately, even when a legitimate dispute arises about the allocation of estate assets, high legal costs can significantly deplete the estate assets.

How do I protect my assets?

Bearing these (and other considerations) in mind, your professional team will advise you on setting up a detailed estate plan. The plan will identify any exposures, taxation considerations, and measures to protect the estate.

"Sometimes it is preferable to organise asset transfers and set up a tailored structure while the individual is still alive"

Your team will prepare a considered legal will, as well as other legal documentation that may be necessary to implement your plan. If you can, avoid the will kits. These are off-the-shelf, cookiecutter documents that are ‘one size fits all’. They are often too simplistic to work well, and while they are inexpensive they can create problems that are much more expensive to solve that the cost savings achieved by using them. The formal will contains the legal ‘wish list’ for your estate assets.

It should cover, at a minimum, directions as to the transfer of your real estate, businesses, companies, trusts, personal assets, including cash and term deposits, and shares.

It should also deal with the payment and servicing of any debts, including bank loans and creditors. Superannuation also needs to be considered.

Sometimes assets are not owned by an individual in their personal name; instead they can be owned by companies or trusts. The will should consider how replacement directors will be appointed to the deceased’s companies or trusts, and methods of instruction to the new directors on how to manage the affairs of those entities.

Consideration must also be given to the terms of the trusts, and the way the estate assets are held; whether changes need to be made to the trusts, and the tax attributes of the assets; and whether any asset transfers will trigger taxes and duties. This is a very complicated topic and is too broad to be glossed over. The take-home point is: get considered advice!

A matter of trust

A useful mechanism that can assist some estates is to introduce a tailored discretionary trust into the will. When that happens, the will nominates a person, called an executor or a trustee, to take the estate assets and hold them in trust for certain individuals or other entities, called beneficiaries.

Until the time comes to distribute the assets to the beneficiaries, the trustee will manage the assets for their benefit. The powerful component of a discretionary trust is that (subject to the way it is drafted in the will) the executor has discretion as to whom the trust’s income or capital should be distributed, and when.

Protections can be included in the will that restrict the executor from distributing the estate assets to beneficiaries when it is not appropriate to do so. This can avoid the estate assets falling into the hands of an impecunious or bankrupt beneficiary.

If the assets are placed into a trust in this way – instead of the estate being given outright to a beneficiary and thus exposed to creditors, the bankruptcy trustee, or the beneficiary’s undisciplined spending habits – the beneficiary will not have an absolute entitlement to the asset and there will be no property that the beneficiary’s creditors or bankruptcy trustee can acquire.

A properly drafted trust can also help protect assets from a family breakdown. With divorce rates increasing, parents will be concerned that their estate should stay within the family.

You can probably gather that in this situation the executor has significant powers to control the estate assets. Because of that, very special care needs to be taken in selecting an appropriate executor – one who is qualified for the task.

Infighting among children

Now how does someone protect against infighting among their children, and claims that children haven’t received fairly? This is very difficult to do. The biggest problem is that when children are fighting over the distribution of an estate, the parent is no longer alive and cannot explain or justify why a distribution was made in a certain way.

To plan for this situation, when writing the will it may be necessary to also prepare another document called a statutory declaration or an affidavit, which will serve as the ‘voice from the grave’.

"A properly drafted trust can also help to protect assets from a family breakdown"

In this document the parent will, in his or her own words, explain the rationale behind why certain distributions were made in the will.

Perhaps the parent had already provided financial help or given an asset to one of the children while the parent was still alive, and the distribution made in the will is a way to even things up. Or there could have been an irreconcilable relationship breakdown between the parent and the child, making a distribution no longer appropriate.

While taking this action will not stop a claim being made on the will, if the parent anticipates there could be a claim, the statutory declaration or affidavit will be a source of evidence that could be used to resist the claim.

The examples above are a very small subset of the situations that could possibly come up, or that may apply to you. Sometimes you may not even perceive the risks. For those reasons, getting professional help is very important as a tool to protect your assets upon death.

The cost of carrying out this exercise correctly is insignificant compared to the cost of getting it wrong or not doing it at all. Unfortunately, the implications of not planning properly for death and protecting your assets only become clear when it is too late.

DID YOU KNOW?

DID YOU KNOW?

In Victoria, the rules for distributing a person’s estate if they have not left a will changed on 1 November 2017. These changes apply to people who die without leaving a will on or after that date. If the person died and left behind a partner, then all of the estate will go to them. If there were also children from another relationship, then some of the estate may also go to those children, but this depends on how much money was left in the estate. This won’t happen unless there is $500,000 in the estate after all debts and funeral expenses have been paid. Different rules apply if the person has left behind more than one partner.

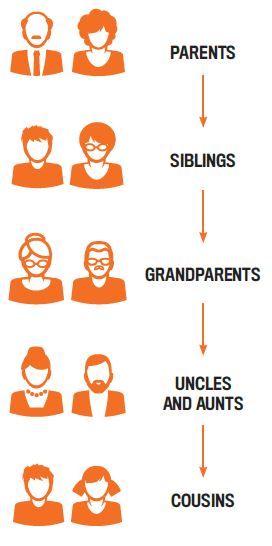

If the person had no partner or children, the estate will not pass to the government unless there are no living relatives. Instead, the order in which the estate will be passed on is illustrated here.

- If you die without a will, you are said to have died intestate. Intestacy rules are in place to determine how your estate will be distributed to your next of kin. It’s estimated that nearly half of all Australians die without a will, or intestate.

- The person who takes care of finalising your estate when you die without a will is called an administrator. The duties of an administrator can include paying debts, collecting assets, finalising tax affairs and distributing the assets in accordance with the intestacy rules.

- The rules around who gets what are complicated, and they vary between states and territories. The best way to ensure your assets are distributed to those you would like to benefit is to make a valid will and keep it up to date.

Daniel Hirsh

Daniel Hirsh

owns Consult Solicitors in St Kilda, Melbourne, where he has

acted for corporates, individuals and syndicates in relation to

their commercial and property transactions and litigation matters

since 2000

.jpg)