28/08/2018

When it comes time to sell your property, whether it’s an investment or your own home, it’s common practice to have an agent on your side.

In many ways, they are the ultimate pillar of the property industry: they are in the market every day, so they have their finger on the pulse of current market trends, and they should ideally have a bulging book of qualified buyers ready to match with your property.

They serve as your advocate, working on your behalf to make sure you’re getting the best deal, and by engaging an agent you are effectively leveraging their expertise and qualifications for your own benefit.

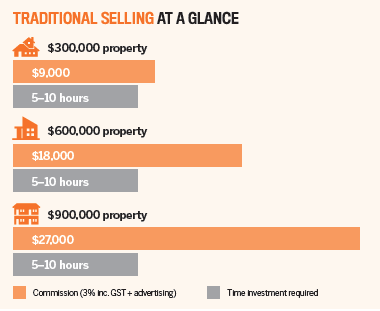

However, not all agents are created equal, and the industry has evolved greatly over the last decade or two. Commission is typically charged at around 2–3% of the sale price, which has been the standard practice for many decades.

But as property values have surged, so too have commissions – and in some cases real estate agents are not evolving with the times to justify their exorbitant fees.

For instance, an experienced, proactive agent will engage in training and development to stay on top of the latest trends. They incorporate videos into their sales campaigns and leverage every opportunity to make connections with new buyers. They work until 7, 8 or 9 o’clock at night, even on weekends, to emotionally coach a buyer through the sale. In other words, they’re earning every penny of their hefty commission.

Other agents, however, don’t work as hard. In booming market conditions they benefit from huge buyer interest, which means they don’t have to put in much effort to round up a bunch of willing and qualified buyers.

On a property sale worth $800,000, assuming a commission of 3% GST inclusive, that agent is making a whopping fee of $24,000 (and that doesn’t usually include marketing and advertising costs). When viewed from this perspective, it’s easy to see why some vendors are looking for opportunities to save money on real estate agents’ costs.

Technology is now on your side, bringing potential buyers to your property’s front door through online platforms. There are also flat-fee services, which create an attractive alternative to traditional methods. Here, we look at the different strategies you can use to save a pretty penny along the way.

Some sellers, particularly those who have worked in the industry or have been investing in property for a while, may opt to manage their property sales transactions on their own. This can be efficient because there’s no middleman delay – and you will obviously have your own best interests in mind.

A common trap for many private sellers is that they tend to overvalue their properties, resulting in very few takers. So the key to getting your property sold is extensive research.

Look through property websites to get an idea of the median property values in the area. Check the prices of recently sold, similar dwellings – not just the listing price but the actual final sale price – to get an accurate comparison point.

Also, be realistic about what your property actually offers. Does it have a pool? Does the kitchen need renovating? Is there off-street parking, or a backyard for kids to run around in? If you’re comparing your property with a neighbouring home that has more features than yours, then you need to adjust your price expectations accordingly.

How you market your property will also be crucial, and will take an investment of time and money. Make sure you get yourself listed on sites like RealEstate.com.au and Domain.com, in addition to having ‘For sale’ signs made up. Print brochures of the property for distribution, and act like a professional by holding regular open house inspections as well.

One of the most difficult things about handling a transaction on your own is price negotiation. Crucially, you don’t have an objective third party handling the process, which means you need to be level-headed to make wise decisions on offers and negotiation techniques. Getting a formal valuation of your home could be very useful, because it gives you an impartial opinion of the dwelling’s worth and helps you stick to your standards, in addition to serving as a negotiation tool.

.jpg)

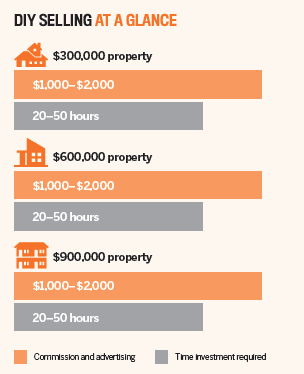

Finally, keep in mind that managing your own property sales transaction isn’t entirely free, unless you don’t place a value on your own time. You still have to invest a significant amount of your time and effort in marketing, liaising with potential buyers, arranging inspections, and researching the market. If you have a job, you’ll need to juggle your property-selling commitments around work.

.PNG)

Flat-fee services are a new trend that has gained investors’ attention. According to research released by Upside Realty in Sydney, around 79% of respondents to its survey believe that agents tell half-truths and allow misconceptions to drum up business, and these property owners are increasingly turning to more affordable options.

“The Australian housing market needs a shake-up, maybe even a revolution. A cocktail of factors, from commission-based agent salaries to the stall in property value, is making selling properties stressful, time-consuming and expensive. It’s not a good consumer experience,” says Adam Rigby, CEO of Upside Realty.

“Commission also doesn’t incentivise agents to get a higher price, and it prompts distrust from property sellers, which is why we are structured in a way that aims to address these issues and provide a more effective solution.”

Under the flat-fee model, a firm will generally take charge of selling a property for a one-off fee that can include auction services, photography and advertising.

“Australians are quite rightly frustrated with the options that have previously been available, and subsequently we are seeing a surge in interest,” Rigby says.

“We calculated how much sellers in Parramatta and Hurstville could save with our flat-fee approach, and the benefit is clear, with a total average saving of $20,800 and $21,500 respectively in these suburbs. Upside’s approach is set to instil some consumer belief in Australia’s housing market.”

Upside Realty is one of the flat-fee service companies that have popped up lately, alongside Purplebricks.

However, with flat-fee services it is absolutely vital that you carefully read through an agreement – especially the fine print – before signing it. For a traditional agent, no sale means no commission. When you engage an agent using the fixed-fee approach, you pay their fee even if your property doesn’t sell. Some argue that this means there is less incentive for your fixed-fee agent to put extra effort into selling your property, and there is the risk that you will pay the fee without achieving a sale.

There’s a reason why real estate agents have been a staple of the industry for so long, and that is because agents do make the selling process significantly easier, given their considerable experience and knowledge of property market trends.

Real estate agents can be relied to leverage the right kind of research and excellent resources to maximise the possibility of a strong sale price. Agents also know how to market a home effectively through different channels, and they have honed their negotiation techniques to help them nab a good price.

A usual trap for many private sellers is that they tend to overvalue their homes, resulting in very few takers

“An agent usually has a team that can work together on multiple buyers at any given time, to create competition and fear of missing out between these buyers, therefore generating a stronger and higher price. This would be difficult for an individual owner to do,” says Josh Hart, director of OneAgency Launceston.

“Negotiating on your own property is a tough conflict of interest, and emotion can take over, especially when a buyer is talking about the negatives of the home you worked tirelessly renovating. Although you may save $10,000 in agent’s fees, you may lose $25,000 by being offended and emotional … which is a net loss of $15,000.”

To address the potential issues of trust, a new bill being instituted by the NSW Legislative Assembly is ramping up the list of criteria one must meet in order to become a licensed real estate agent.

“The days of becoming a real estate agent in less than a week are finally over,” says Tim McKibbin, CEO of the Real Estate Institute of NSW.

“Under the reforms, education requirements for a career in real estate will increase by 600%. This is a win for the consumer and the property services industry, because a better agent delivers a better consumer outcome.”