Jeremy Iannuzzelli is the first to admit that he’s a research freak. Unlike some investors who are able to take the plunge by simply doing rudimentary calculations and research, Jeremy insisted on going through rigorous due diligence right from the very start.

This means spending a whole year learning about the property markets and attending open houses to get a feel for what’s selling and for how much.

“I was about 22 years old when I started investing in property. I’m now 26. Before I bought my first investment property, I was attending a minimum of five open houses each weekend. I’ve attended many auctions, not bidding but just looking and observing. I’ve probably viewed at least 250 properties during that time.

“I spent that time getting my foundations right because I believe that the first property is crucial. You can only get one shot at it. Yes, I know property is for the long term, but my strategy is to build my portfolio quickly and safely, so I wanted to make sure I don’t have bad eggs. So I’ve decided to spend time to do the research, understand the market and what I want, and when the time comes I’ll know,” he explains.

Taking a giant leap, quickly

That moment finally came in the form of a phone call from an agent who he met and developed a relationship with.

“The opportunity fell into my lap, but I still did a quick calculation based on current interest rate and potential rent. The numbers stacked up and the location met my criteria: close to transport, amenities, schools, shops, restaurants, etc. I thought there’s little risk based on those things,” Jeremy recalls.

“I found this property as a result of me getting out there and meeting real estate agents and telling them what I was looking for. I told them I was ready to buy, that I’d got finance pre-approved. It was a phone call I received late at night. After doing a 15-minute search on the internet and checking what the comparable properties were selling or sold for, this gave me an understanding of the value of the property.

“This helped me make my decision a little faster. By 7.30am the next day, I signed the contract. It was a quick decision, but I still had to do my due diligence. With all the research that I’ve done I get to make a calculated decision.”

Managing risks

Jeremy may sound like a man on a mission, but he’s a conservative investor. His aversion to risk is clearly reflected in his choice of investments. To ensure that he cuts down on his risks and maximises his returns, he buys properties with strong cash flow and as close as possible to capital cities. This ensures that he won’t have to worry about supporting his investments and will also get the capital growth he’s after.

“People have different tolerance of risk, and I’m a very conservative person by nature. I prefer to have a property that I know the rent is going to cover the interest payments, and anything on top of that is a bonus.

“My first property had a yield close to 7% of the purchase price and I knew straightaway that it would cover my interest payment as well as part of my cost. Being close to the M5 and located 45 minutes from the city, it was a

no-brainer in terms of location. It’s also close to local schools and shops. Taking these factors into account helped me make a quick decision to go ahead.”

Going forward, Jeremy ensured that any property he bought earned a decent income.

“I believe that you’ll reap the maximum benefit of your investment property if you’re able to hold it over a long time. You’re only able to do this if you have strong cash flow,” he says.

Getting over initial setback

While Jeremy did all the preparation he needed to get started in property investing safely, he admits he had to overcome a number of challenges along the way.

“My family’s opinions were my biggest setback,” he says. “There were simply too many different opinions that I need to sift through.

“When the family gets involved, they tend to impose their views on what you should be buying. Because they’re thinking like homebuyers and are more emotional, they have certain ideas of what type of property and where I should be buying. I have to overcome that. I realised you really have to make your own decision and create your own path.”

Jeremy’s obsession with research has also cost him valuable time, and the resulting indecision has further set him back.

“I suffered from analysis paralysis in earlier years,” he admits.

I was able to purchase a long time before, but I was too stuck on every figure rather than seeing potential in the properties.”

He was also afraid of getting into big debt, which further held him back from making the first move.

“It was a bit of a shock to get into seven-figure debts, but when I saw the asset from the other side of that debt, it made it easier for that debt to swallow. Having the rental income to help service that debt is also good to see,” he says.

Expanding his portfolio

After Jeremy settled his first property, it would only take him three months before he was ready to go again.

“I bought my next properties in fairly rapid succession,” he says. “My first property grew in value quickly, so I was able to extract equity from it without reno and buy again without using my own money. It was a short three-month wait. After that I was able to buy two more that year, bringing my total to three in one year. After that, I’ve been able to buy one property a year, sometimes up to two properties.

“I bought my next properties in fairly rapid succession,” he says. “My first property grew in value quickly, so I was able to extract equity from it without reno and buy again without using my own money. It was a short three-month wait. After that I was able to buy two more that year, bringing my total to three in one year. After that, I’ve been able to buy one property a year, sometimes up to two properties.

“I’m glad that the first one was a success because it’s given me a fantastic foundation which enabled me to buy more properties thereafter.”

Besides doing the footwork, Jeremy had used CoreLogic RP Data research to gauge the potential of the property. He also tapped his mentor’s expertise and surrounded himself with experienced investors.

“I trawled Domain and RealEstate. com.au. But nothing beats getting out there and touching and feeling to gauge what types of properties are selling,” he says.

Hitting the financial brick wall

Jeremy’s successful first foray into the property market was partly due to his astute financial sense. Being a hard saver, he ensured that he had enough deposit when he bought his first property.

“I went in with a good deposit to avoid lenders mortgage insurance[LMI], because it’s a non-refundable cost,” he says. “Yes, it’s tax deductible over five years, but it’s a reduction of your equity. LMI is a great way to increase your leverage and grow your portfolio, but where possible you want to reduce the LMI that you pay.

“I want to be in a position where I have access to equity and a good interest rate. Initially I went in with the strategy of getting the best interest rate and paying no LMI.”

However, it didn’t take him long before he came to a roadblock when the banks stopped lending.

“They told me they couldn’t help me going forward because my serviceability was a bit tight. That’s when I refinanced with another bank and this enabled me to borrow more money. Their lending criteria were less tight, and they gave me more flexibility in extracting equity from my portfolio.

“I hit this serviceability wall at property number four. After refinancing with another lender through the advice of my broker, I was able to buy three more after that.”

My secret to worry-free investing

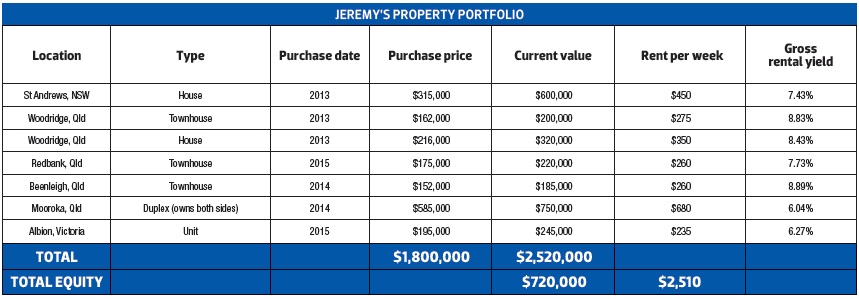

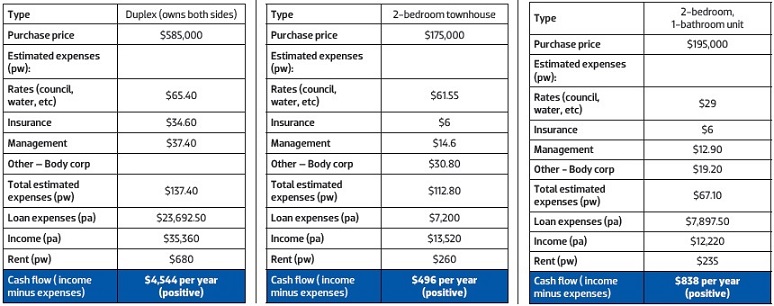

While Jeremy believes you get rich through capital growth, he also believes cash flow is what fuels your portfolio over the long term.

“All my properties are either cash flow neutral or slightly positive. Every now and then there’s some maintenance involved, and this will bring my cash flow to neutral that month. But, broadly, they’re achieving around 7% gross rental yield and are slowly becoming positive, especially at this time of low interest rate.”

Even then, Jeremy insists on keeping a buffer of three months’ worth of expenses for when there’s no rental income coming into a property.

“I like to buy in an area where there’s a low vacancy rate, and I tend to get tenants straightaway. I find a three-month buffer including mortgage repayments, management, rates, with no rental income coming in is a comfortable amount for me. It enables me to make decisions easily.”

Jeremy also likes to keep his borrowing low against the property value. At the moment, his total loan-to-value ratio is 65%. He says this gives him enough wiggle room in case the unforeseen event happens.

“I’m not too concerned about immediate capital growth because I buy properties as close to the city as I can to get good yield. I believe growth will come by virtue of their proximity to the city. Whether it comes in the first three months or year, it will come, as long as you’re buying in the right climate.”

Best decision I ever made

“Without a doubt, the best decision I’ve ever made was to get started when I did,” says Jeremy. “By not allowing analysis paralysis to rule me, I was able to get my portfolio off the ground quickly and safely.”

He also believes his meticulous research has ensured that he has never had a ‘bad investment’ in his portfolio.

“I always made sure I did my due diligence. I’ve always ensured that I did a good amount of research before buying to make sure I was well informed. But, most importantly, I took action and made it happen.”

Jeremy’s decision to go against the flow has also allowed him to cherry-pick his properties before the mainstream investors moved in.

“Sometimes it’s better to be the first person rather than following the crowd,” he says.

“When I bought in Queensland two years ago, it was behind NSW and Victoria. No one was buying there, so I was able to get in and get high cash flow properties.

“It wasn’t long after that before the herd of mum and dad investors caught up and started buying. If you’re going to buy there now you’ll probably get just above 6%, but no more than 7% yield like I did.”

Jeremy also decided to stay with his parents while he was building his portfolio, to help ease the financial burden.

“When I was starting out, I was living at home with my parents up until my fifth property, and then I made the decision that I needed to experience life on my own. It was so much easier to start investing while I was living at home.

“Without the option of living at home, I wouldn’t have been able to buy what I bought. It really set me up. Not everybody has the opportunity to do so.

“But even if I haven’t been able to live at home, I would have still found a way to build the same-size portfolio.”

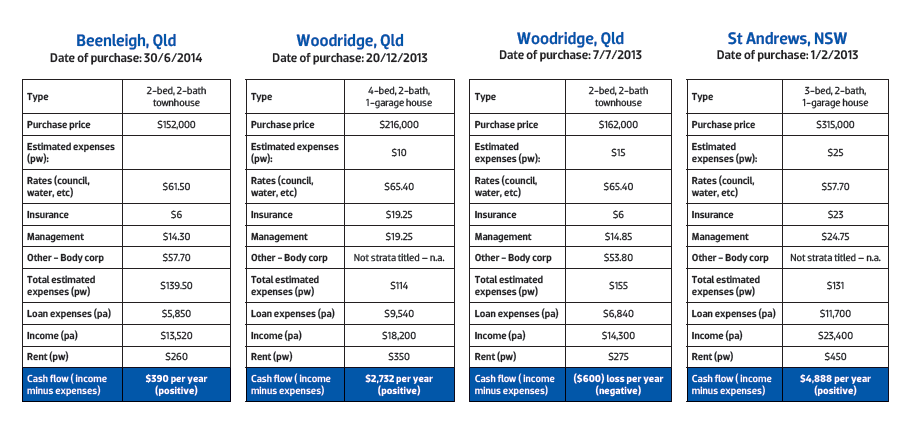

PROPERTY HIGHLIGHTS PROPERTY #1: ST ANDREWS, NSW

Property #1: St. Andrews, NSW

PROPERTY DETAILS

Property type: House – 3 bedrooms, 2 bathrooms and one lock-up garage

Purchase price: $315,000

Current value: Bank’s valuation: $530,000; comparable properties in the market are selling for $600,000 plus

Current rental yield: 7.4% on purchase price

Location: St Andrews, NSW

FINANCE

“I was earning around $50,000, including super. I was living at home during that stage. I saved enough deposit, in this case $60,000, to avoid paying lenders mortgage insurance.

“I took the loan with Bankwest at the time at a 5.5% interest rate. My broker has got this down to now 4.4% with CBA.The broker chose the lender with the best rates and accessibility to the funds that suited me and my situation at that time. I was very happy with the decisions made; I wouldn’t change much.”

RESEARCH

“I chose this suburb because it was close to home and I knew the area quite well. I’ve done plenty of research and attended lots of open homes before

buying. “I used RealEstate.com.au a lot and was able to draw upon the experience of another investors and mentors, such as my father and boss at the time. My main criteria were land component, stand-alone house, close to transport, no renos needed, and must have great cash flow. “This property was the best of the lot that I was considering and it fell in my lap. I bought it after eight hours of good sleep.”

GUT INSTINCT VS HARD NUMBERS

“Because I knew my numbers before buying, I had a rough idea of what I wanted, and this property fit the description. Gut instinct was a major factor but you need to do your numbers, and as an accountant I can’t overlook the numbers.”

PERFORMANCE

“This property has been fantastic and gave me a solid platform for my portfolio. It has been my best performer in terms of capital gains, and I believe it has much more to go. However, some of my properties in Queensland have achieved better gross gains. “It has low debt and I can offload it anytime if I want to. It has grown a lot in value since I bought it.”

CHALLENGES

“The biggest challenges have been picking the right tenant who will appreciate your property as much as you do, and choosing the best property manager.”

MY RECIPE FOR SUCCESS

• BE OPEN-MINDED

“I don’t put a ceiling on what price and what type of property I buy. I believe a good deal is a good deal. I’m open-minded and explore all the options.”

• FOCUS ON CASH FLOW

“I’m a strong believer in cash flow and the ability to hold property. Holding it for the long term builds wealth, so I buy in good locations that have good transport, amenities, schools and so on. The property must be in high demand and achieve a decent yield.”

• BE ACTIVE IN PICKING YOUR TENANTS

“Make sure you run a rigorous background check and don’t just rely on your property manager to vet tenants.”

• ALWAYS HAVE A GOOD BUFFER

“I had bad storms and trees collapsing and damaging one of my properties.

I had a couple of instances where water leaked through the roof. I accept these challenges as part of investing. That’s why I insist on having a good buffer. There are always expenses and you should plan for major maintenance every five to six years, but having the right insurance will always help.

“I create buffers by extracting equity from my property. I use that equity not to purchase more properties but to just have for a rainy day. I also try to save half my gross wage per week.”

• GET THE RIGHT PROPERTY MANAGER

“Picking the right property manager is a bit of trial and error. You need to go through the bad ones to get to the good ones. I always say it’s a three-month probation. If they’re not good then I move on to the next one, but word of mouth is also important.

“Referral is a good thing but I’m not afraid to move on to the next person if I’m not happy with the manager. You need to keep on top and check your monthly statement to see what’s being spent on your property.”