Following are some of the issues that should be considered and agreed, bearing in mind that tailored advice is critical as everyone’s position is different.

How it works

If proper structuring advice was obtained and heeded when the family home was originally acquired, the property is often held by the individual who is exposed to lower risks (eg a non-working spouse). Alternatively, the home may be jointly owned by the couple, either on a 50/50 or disproportionate ownership basis.

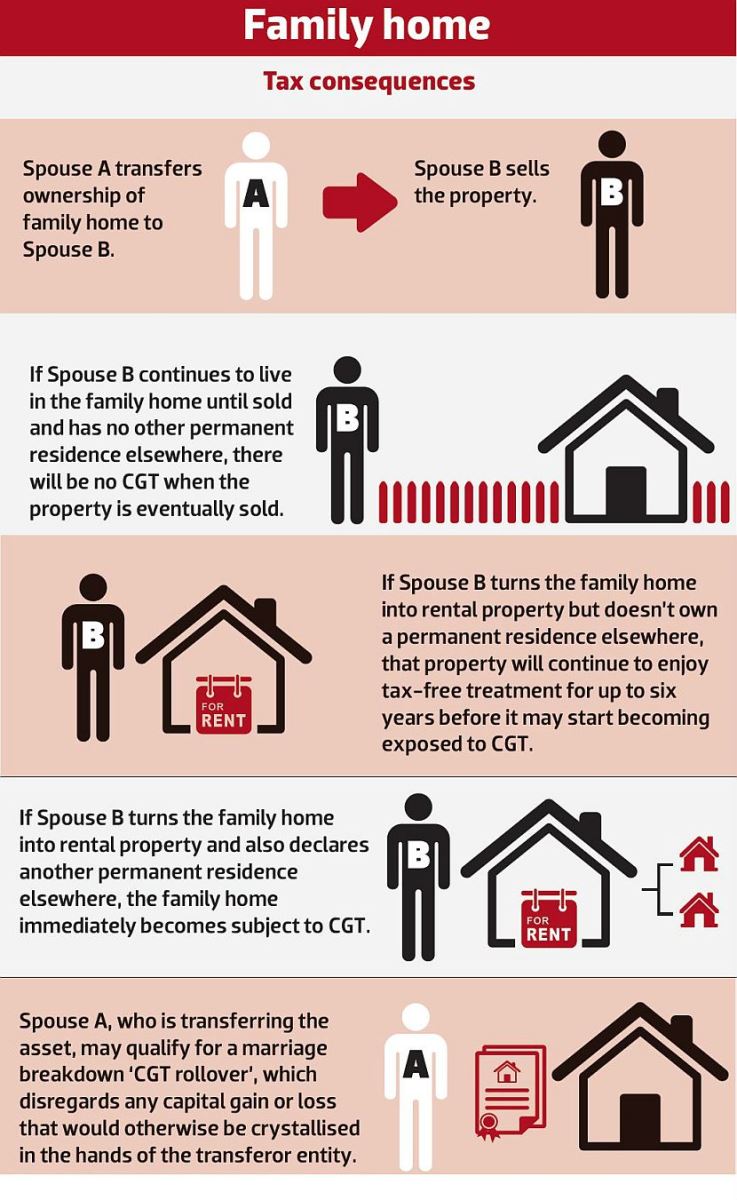

If the home or an interest in the home (assuming it was purchased after 20 September 1985) is transferred to one of the individuals as a result of the divorce, and the recipient subsequently sells the property, whether the sale will attract capital gains tax (CGT) will depend on how the property has been used after the marriage breakdown.

If the transferee spouse has continued to live in the property until it is sold and does not own another home elsewhere, the main residence exemption will continue to apply and the property will not be exposed to any CGT on sale.

If the transferee spouse has started renting out the property after the divorce but does not own another home elsewhere, the temporary absence rule will apply – the property will continue to enjoy tax-free treatment for up to six years before it may start becoming exposed to CGT.

On the other hand, if the transferee spouse has started renting out the property after the divorce but owns another tax-free home elsewhere, the property will cease being a tax-free main residence at this point. Assuming that the property was never rented out before the divorce, a special cost base rule will then apply, such that the transferee spouse will be deemed to have acquired the property at its market value when it first became available for rent; this market value will become the cost base of the property for the purpose of calculating the future capital gain on the property when it is eventually sold.

It is important to note that special rules apply if the couple own two dwellings. Before they are permanently separated, they may either choose one of the properties as their sole tax-free main residence or nominate both properties as their main residence but claim a partial main residence exemption on both properties. However, once the couple have started living permanently apart, they may start claiming one main residence exemption each as they are essentially treated as unrelated individuals once they are separated.

While the rules above seem relatively straightforward, if the divorcing couple own multiple properties or have used their home for other purposes before the divorce, the tax treatment can become complex.

Other CGT assets

By default, under the CGT rules, if an entity transfers a valuable asset such as an investment property that was originally acquired by the entity after 20 September 1985 to another entity, the transfer will normally give rise to a CGT event due to the asset disposal. If no consideration is paid on the transfer, or the consideration is more or less than the market value of the asset transferred and the parties are not dealing with each other at arm’s length, the market value substitution rule will apply as if the transferor entity has disposed of the asset at its market value. The transfer may also give rise to stamp duty based on the market value of the asset.

However, if an asset is transferred as a result of a matrimonial property division for no consideration, provided that certain conditions are met, the spouse transferring the asset may qualify for a marriage breakdown ‘CGT rollover’, which applies to disregard any capital gain or loss that would otherwise be crystallised in the hands of the transferor entity. If the rollover applies, the transferee spouse acquiring the asset will be deemed to have acquired the asset at the original cost base of the asset previously in the hands of transferor entity.

Importantly, as mentioned above, a key condition for the CGT rollover to apply is that it must be transferred under a formal agreement or settlement (eg pursuant to a court order, maintenance agreement, binding financial agreement, etc). If the transfer happened as a result of a private agreement between the parties that was never formalised under one of the prescribed conditions, the rollover will not be available, which may give rise to unintended adverse tax outcomes. Professional advice should therefore be sought to avoid such costly mistakes.

- Transferee entity

While this issue may be resolved by ensuring that the relevant asset is transferred to the transferee spouse as an individual, any subsequent transfer of the asset by the transferee spouse to a related entity to achieve other purposes (eg asset protection) may trigger CGT on the value increase on the asset between what the transferor entity originally paid for it and the market value of the asset when it is ultimately transferred by the transferee spouse to their related entity. In other words, if the transferee spouse insists on having the asset held by their related entity after the matrimonial property division, special care must be taken to understand the potential CGT implications before the subsequent transfer is effected.

- Pre-CGT asset

- 50% CGT discount

A special acquisition rule applies to determine if the transferee spouse has held the asset for at least 12 months in these circumstances – the 12-month period is counted from the time when the transferor entity originally acquired the asset before the matrimonial property division to when the asset is eventually sold by the transferee spouse. Therefore, applying this special rule correctly can result in substantial CGT savings.

Private company

If the divorcing couple have a private company in their family group, the normal ‘dividend provisions’ and ‘deemed dividend provisions’ (commonly known as the ‘Division 7A rules’) may give rise to unintended tax consequences without careful tax planning.

Under the normal dividend provisions, if a payment is made by a private company, or an asset owned by a private company is transferred to a transferee spouse who is a shareholder of the company, the payment or value of the asset transferred will simply be treated as an assessable dividend in the hands of the transferee spouse. The dividend may be franked in the usual fashion to the extent that the company has sufficient franking credits.

On the other hand, if the transferee spouse is an associate of a shareholder of a private company, the Division 7A rules will also apply to the extent that the company has a ‘distributable surplus’ (eg it has undistributed profits) – in which case, in accordance with the Commissioner of Taxation’s current interpretation of the law, a payment or transfer of property by the company to the transferee spouse will give rise to a deemed dividend. However, provided that the payment or asset transfer is effected pursuant to Section 79 of the Family Law Act 1975, the deemed dividend may also be franked to the extent that the company has franking credits.

To that end, consider the scenario where a post-CGT asset transferred by a private company to a transferee spouse who is an associate of a shareholder of the company has given rise to a deemed dividend in their hands. Despite the fact that the deemed dividend may be franked and the asset transfer qualifies for the marriage breakdown CGT rollover, when the transferee spouse eventually sells the asset, they will be required to pay CGT on any capital gain accrued on the asset from the time it was originally acquired by the company, which will effectively give rise to double taxation.

Further, for Division 7A purposes, a payment by a company includes the right granted to a shareholder or an associate of a shareholder of a private company for them to use the company’s assets for private purposes. Therefore, if a party to a divorce is granted a right to use an asset (eg a holiday house) that is owned by a private company, the value representing the right to use the asset may also be treated as a taxable deemed dividend. The Division 7A rules will also apply if a private company with a distributable surplus makes a loan to a shareholder or an associate of a shareholder that remains outstanding by the end of the income year, unless the loan is commercialised under prescribed loan terms or is fully repaid by the lodgement (or due date for lodgement, whichever is earlier) of the company’s taxation return for that income year. A deemed dividend may also be triggered if the loan is forgiven by the company.

It should be apparent by now that these rules pertaining to private companies can be extremely complex and difficult to manage. Accordingly, professional advice is a necessity for understanding all the potential taxation implications before any formal agreement between the divorcing couple is finalised when private company dealings are involved.

Conclusion

The above highlights some of the common tax issues that are encountered when a divorcing couple are splitting their assets. Apart from the fact that the tax law is a ‘tax minefield’ on its own, trying to apply the law to specific circumstances will often unearth even more complexities that make a difficult situation more challenging. It is in situations like this that a trusted professional tax advisor may prove to be your most valuable resource yet.

Eddie Chung is Partner, tax & advisory, property & construction, at BDO (QLD) Pty.

Important disclaimer: No person should rely on the contents of this article without first obtaining advice from a qualified professional person. The article is provided for general information only and the author and BDO (QLD) Pty Ltd are not engaged to render professional advice or services through this article. The author and BDO (QLD) Pty Ltd expressly disclaim all and any liability and responsibility to any person in respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance, whether wholly or partially, upon the whole or any part of the contents of this article.