In a perfect world, your investment properties would be fully tenanted, easy to manage and growing in value year-on-year.

In reality, however, you occasionally face bumps in the road – and your success as a property investor may depend on how you cope in a crisis.

Therefore, you need to consider and plan for the worst to be prepared for any situation, before they arise, says Jamee Jenkins, buyers agent and founder of JPC Property.

“Well before buying, you should always work through the figures and stress test various situations, and you should only then proceed if it’s okay to do so. Sometimes this may mean asking yourself: can you really afford to buy?”

Investing is all about managing risk and the best defence against risk is planning for the worst and making sure you research, negotiate and buy like a professional,” says Ben Everingham, investor, buyers agent and director of Pumped on Property.

“I also believe most people rush into decisions too quickly. The best investors I know take their time and make sure every purchase is the right one.”

For instance, Everingham says investors often make hasty purchases in sub-prime markets, such as mining towns and regional communities with small populations.

“These areas represent risk in terms of slow growth, average rental yields, high vacancy and large price fluctuations. If I can see a market is missing long-term population growth, mid-term job growth and strong historical capital growth, and a property is missing the ability to buy below intrinsic value and manufacture growth, then it doesn’t represent a strong investment opportunity in my view.”

Even if you have done your due diligence, crossed your t’s and dotted your i’s, problems can still arise. How you react to these situations can make or break your investment career and impact your long-term success.

.JPG)

The key to mitigating this risk, as with most property risks, lies in the planning. In a nutshell, you need to prepare to be able to cope well financially in advance of this ‘worst case scenario’ actually happening. This means establishing a financial safeguard by setting up and saving an appropriate cash buffer, says Christine Williams, principal of Smarter Property Investing.

Obviously, the more cash you can squirrel away to see you through hard financial times the better, so if you can afford to set aside 12 months’ worth of living costs, that is ideal. That said, Williams advises that a minimum of 12 weeks’ income is usually the benchmark she sets for investors.

“When I talk to people about creating a buffer, the majority of them say they would need to cover a three- to six-month income shortfall,” she says.

“Most people ensure they have around $15-20,000 available. Often they have a good amount of equity in their own home and they’re comfortable to set up a buffer using this equity in an offset account.”

Having a buffer to support you through times of income stress is only one part of the picture.

“If an investor’s biggest fear is losing their job, the other thing I recommend is that they get income protection and Total Permanent Disability (TPD) insurance. Both insurances are 100% tax deductible due to buying an investment property,” Williams says.

“The benefit of these insurances is that by protecting the payment of their investment asset, they’re also protecting their personal assets, such as their own home, as it pays the mortgage. This becomes a win-win situation.”

.JPG)

Whether it’s through illness or redundancy, coping with job loss can be one of the most stressful times you’ll experience. Add the responsibilities of an investment property to the mix and the situation can be made even more difficult to handle. Jamee Jenkins offers the following tips to help you navigate this road as smoothly as possible.

1 Make sure you check your entitlements to ensure you have been paid all that you are entitled to by your employer. Is your superannuation paid up to date? Long service leave? Holiday leave? Overtime?

2 As soon as possible, seek any relevant government assistance you may be entitled to, such as Centrelink support.

3 Speak with your bank and review the possibility of taking a mortgage holiday.

4 Review your property portfolio and look for opportunities to convert your mortgages into interest-only loans, thereby reducing your immediate financial commitments.

5 If you own a large house, consider renting out a room

(either permanently, or on a holiday-let basis through Airbnb) to supplement your income.

6 Depending upon your situation, consider renting your home out and moving in with relatives as a short-term, cost-saving measure.

7 Do you have transferable skills? While looking for full-time work, look at other areas to generate income.

.JPG)

Income protection insurance is also useful to protect yourself against losing your income due to illness or accident.

Luke Woollard, principal of real estate agency PILOT based on the Mornington Peninsula, says this policy should be considered absolutely mandatory for every investor – regardless of your industry or income level, or whether you’re self-employed or a PAYG earner.

“The premiums can be covered in your superannuation, so you’d be mad not to do this,” he says.

Most income protection policies have a waiting period of between 30 and 90 days, so you’ll still need a source of income to cover you until your insurance kicks in.

This is when your buffer account can take the edge off your stress levels, but it’s important that you get the right type of insurance and level of cover for your situation. If not, you can find yourself in a world of financial pain, as one investor found out the hard way.

“If you increase your levels of debt then you should also insure your risk level appropriately, in case the unexpected in life occurs,” advises Paul Wilson, investor and director of We Find Houses on the Gold Coast.

“I had a client last year who didn’t take out the insurance level that was recommended to him, to cover his income in the case of a sickness or accident. He was young and fit and didn’t see it as a high priority. Unfortunately, he badly hurt himself in a kite-surfing accident and can't work for more than four months. He is regretting not taking out that cover now.”

Wilson suggests that investors should treat risk and wealth protection the same as they would car insurance.

“You wouldn’t drive your new BMW out of the showroom without full insurance cover, and you are more valuable than a BMW, so give yourself the respect you deserve and put the right protection in place for yourself and your family,” he says. “There is no point pushing a ball halfway up a hill to have it roll all the way back to the bottom again.”

.JPG)

It’s unlikely that you’re going to end up on the nightly news, sadly standing in front of a disgraced property that squatters have taken over, long after rental payments have stopped.

But if you get lumped with a tenant who maliciously and intentionally damages your property, you could end up paying a hefty financial price by leaving yourself exposed to this risk.

You could also have great quality tenants who treat the property as if it’s their own home, but who cause accidental damage – leaving you with a financial nightmare on your hands as you work out how to rectify the problem.

Again, insurance is your best friend here, this time in the form of landlord’s insurance.

“I don’t mean take out a ‘token’ landlord insurance policy,” clarifies Wilson. “Make sure you research what is and isn’t covered and pay the right amount for a premium for cover that protects you if the unfortunate situation like this occurs.”

If your tenant damages the property and does a runner, you may need to involve law enforcement, advises Belinda Butler, Insurance Distribution Manager at Terri Scheer.

“If a tenant purposely trashes and abandons the property, landlords should notify the police immediately. If it’s safe to do so, they should also secure the property to avoid future entry and further damage,” Butler says.

“Preventative measures can minimise the risk of attracting a tenant who is likely to damage property. For instance, appointing a property manager can be a worthwhile risk management investment. Property managers have access to tenancy databases, have experience in screening potential tenants, and can conduct property inspections on behalf of the landlord.”

.JPG)

A property becoming vacant isn’t a disaster in itself, it’s simply part of the property investing experience.

Landlords should expect and budget for a vacancy of up to a week or two between renters, every 12 months or so.

But if your property struggles to attract a new tenant for several weeks – or worse still, several months – that might suggest you have a problem on your hands.

“It’s all about profit-making and empty properties empty investors’ pockets,” says real estate agent and investor Luke Woollard.

To deal with the odd period of vacancy, Woollard returns to a popular tried and true strategy. “I’d suggest you get a fat wad of cash as a buffer in your bank account. I think three to six months is about right to take the pressure off,” he advises.

“If you don’t earn enough to save a buffer, perhaps seek a line of credit on your PPOR and leave the cash alone. But I’d also suggest selling a property if you experience more than four weeks of downtime in a 12-month period, as that shows there is clearly weak rental demand for the area.”

How to combat vacancy periods

- Ensure you have a well-maintained property, even during periods of vacancy.

- Mow the lawn, tidy the garden and empty gutters to ensure strong street appeal for a positive first impression.

- Clear overflowing letter boxes so the property doesn't look empty.

- If you’re time-poor or don’t live locally, consider hiring a professional to complete these tasks on your behalf.

- Consider advertising the property with a slight rent reduction to broaden the pool of prospective tenants.

- Make small renovations, such as a refreshing coat of paint, new carpets or a garden make over to help improve attractiveness of the property.

Current mortgage interest rates are amongst the lowest that investors have ever enjoyed.

But we can’t expect rates to stay this low forever, should we be surprised when our mortgages eventually start creeping up. “Rising interest rates shouldn’t impact on any investor, as it’s the nature of investing,” Wilson says.

“When you borrow the banks put in a buffer for serviceability to ensure that you can manage when interest rates increase. Often, I see people over-consuming on their lifestyle choices and these choices have a bigger impact than any interest rate rise usually has. Sometimes we need to pull in the purse strings and opt for more affordable choices in our discretionary spending. You would be surprised how much extra cash you can actually accumulate.”

Ben Everingham suggests that investor you should follow the banks’ lead and always calculate your cash flow based on a 7% interest rate.

“If the property does not work at 7% then it doesn’t work at all. I like to keep any passive income generated through an investment property until the end of the financial year as a buffer against all of the things that will go wrong over a 12-month period.

“At the end of the financial year I repay this passive income off the principal of the loan then start accumulating a buffer again. The best buffer against interest rate rises is debt reduction.”

Having your investment drop into negative equity is a scary prospect. Not only does it impact your financial position and your ability to keep investing, but it also does a number on you psychologically.

When your investment doesn’t perform as you expected,

it can knock your confidence, so it’s important to understand that being in a negative equity situation doesn’t mean you’ve necessarily lost money.

“While this might be distressing at the thought, you need to go back to your cash flow calculations and look at what the actual holding costs are, so you can understand the real cash impact of holding onto the asset,” Wilson explains.

“The equity may have dropped but the cash flow might be positive or neutral, so you may be able to manage even with it being slightly negative. Remember, as with shares, a loss is really only a loss if you sell at the low point, which crystallises the drop.”

If you do make the decision to sell and incur a loss, speak to your accountant first, especially if you are also intending to sell a property with a capital gain, as the loss can offset the gain if the structure is right.

Christine Williams also advises that markets are cyclical, so if you’re able to hold onto the asset, the price may rebound.

“Recorded property history tells us that, eventually, the property cycle will return and it will go from a negative equity into positive equity,” she says.

“If people go into property and hold it for 10 years, sometimes it will go into negative equity, but it will return. It’s generally in a period of one to five years where people can get into trouble for reasons such as they have bought at the peak of the market, and after a peak, generally property retracts for a few years.”

3 strategies to protect against negative equity

1 I like to pit a 20% deposit down on every investment property I purchase. This gives you a significant buffer from our bank should the market drop in value by anywhere between 5 and 15%.

2 I also like to buy below market value so there is an immediate buffer between your property and the market.

3 I try to buy property with the opportunity to manufacture growth: renovation, secondary dwellings or subdivision. This means if the market drops or sits flat, I can still create a capital gain and release equity to keep moving forward.

Source: Ben Everingham, buyers agent and director of Pumped on Property

Milly Bridgen: “My $300,000 learning curve”

No landlord is immune from making mistakes or experiencing some mishaps during their investing journey – but some of those mis-steps are easier to live with than others. For investor Milly Bridgen, her biggest regret in real estate was making the wrong call at the wrong time, which ultimately cost her $300,000.

A long-time investor, Milly Brigden, co-founder of Property Investor Solutions, believes that every landlord is destined to encounter some challenges when building their property portfolio.

But that’s just part of the process, as some setbacks are learning curves designed to turn you into a savvier investor.

While that experience cost Milly a pretty penny, it wasn’t to be the last time she would kiss profits goodbye in a property deal.

Today, Milly firmly believes that a ‘buy and hold’ strategy is best poised to deliver long-term returns.

But Milly hasn’t always held this view, and admits that over the years she has given into the temptation to make a quick buck. This means she has “sold a few properties I really wish I hadn’t”.

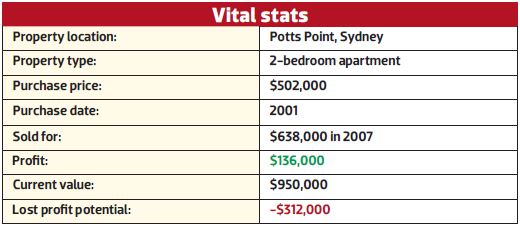

“I purchased a two-bedroom apartment in Potts Point in 2001 for $502,000 and sold it in 2007 for $638,000,” she says.

“Even though I made a profit, I wish I had taken my own advice and held it, as it just sold recently for $950,000. I could have added another $300,000 to my bottom line!”

For every property regret, however, Milly says there is always a silver lining to be revealed from the experience – whether it’s a new lesson, a new opportunity or sometimes even a surprise profit.

“We actually had a fire at a townhouse we owned, but luckily we were insured,” she says. “We ended up getting a new fitout, which boosted the property’s value by $35,000.”