What is negative gearing?

Negative gearing is using a loss on a particular asset investment, for example an investment property, and being able to offset this loss against your other taxable income. Many people with high taxable incomes consider negative gearing to be a tax strategy to reduce their overall income tax.

What is positive gearing?

Assets that are positively geared generate more income than expenses. This is always a good problem to have because it means the asset is generating more income than it costs you to hold.

Is negative gearing for me?

When going into a negatively geared asset, you need to closely consider the following:

-Am I able to meet the shortfall difference between the income and the expenses on a weekly and monthly basis?

-Have I got sufficient buffer to handle a real long-term downturns in the economy? Or decreases in rent?

-Am I sure the assets I am purchasing will grow long term?

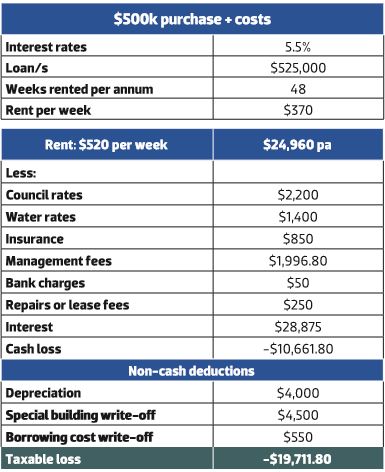

The example below demonstrates how the negative gearing concept works.

How do we calculate your tax loss?

Taxable loss

As the example shows, rental income is received and then direct cash costs such as council rates, water rates, insurance, management fees, bank charges and repairs are deducted to give what we call an ‘initial cash loss’.

In addition to the cash costs of the property, the non-cash costs of the property – such as depreciation and special building write-off – can also be deducted from the taxable income from the property.

In the example, the taxable loss of the property is calculated after these non-cash costs, showing a loss of $19,711. Depending on what your marginal rate of tax is, the equivalent tax benefit is the taxable loss multiplied by your marginal tax rate. Please note that if you earn between $37k and $80k, you only get 34.5c/$1, but between $80k and $180k you receive 39c/$1. If you are on the highest marginal tax rate, above $180k, you receive 49c/$1.

The real cost of the property (after-tax cost of the property) is simply the cash loss less the tax benefits.

You should note that you can actually get these tax benefits back via your employee payroll system by means of a PAYG Withholding Tax Variation (1515). This enables the tax benefit you receive from your negatively geared asset to be paid to you with each salary payment by having the amount of tax you pay out of your salary appropriately reduced.

Politics and negative gearing

Unfortunately, at present, the talk of abolishing negative gearing in part creates uncertainty when an investor is making an investment decision.

The policy announced by the Labor Government to limit negative gearing in the future to new housing will create a limited sale market for any existing properties being sold.

Ramifications of the change in policy are as follows:

1. If a new property is built in the future but negative gearing is not available, once that property is initially sold what market will there be for the sale of second-hand investment properties?

2. If negative gearing is no longer available for older properties, there will be much less incentive for investors to refurbish and make improvements to these properties.

In our view, the current discussion about negative gearing is unhelpful. Negative gearing has already been abolished once, and it is still doubtful whether it will be abolished or changed in the future.

Risks associated with negative gearing

-Interest Rate Fluctations

-Capital growth not exceeding rental losses

The above comments by WSC Group are of a general nature and do not constitute specific financial advice. For a detailed financial strategy you should consult a qualified financial advisor before making any investment decision.