In this article WSC Group pinpoints the importance of ownership and loan structures to ensure tax deductions are maximised for the property investor.

During the tax season I am continually reminded of the importance of having the correct ownership structure together with the right advice on the structure of investment property loans.

Ownership Percentages

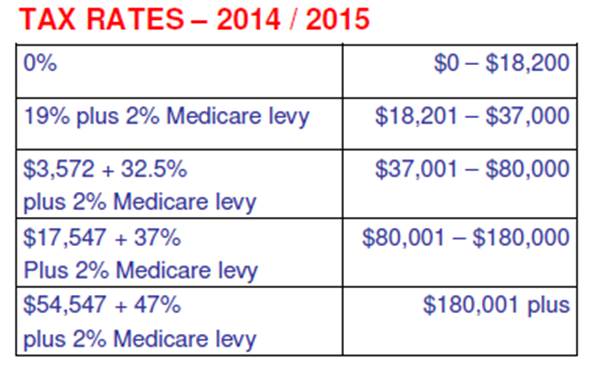

Below are the current tax rates for the 2014/2015 year

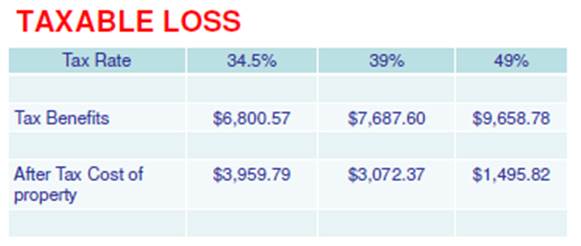

As property investor tax deductions are calculated at the marginal rate, before making investment property purchases it is important to look at how you can achieve the maximum tax benefits from an investment purchase. Below is a simple example of how we calculate the taxable income and tax benefits derived dependent on your margin of tax.

.jpg)

From the above example, it becomes obvious the importance of the higher income earner to have the higher percentage of ownership. The difference in tax benefits for someone on $200,000 compared to someone earning $70,000 is $2,850 p.a. that could be used to pay off debt on the investment property.

Some important questions to ask yourself when you are purchasing an investment property are:

- When two parties are involved in purchasing a property, “Who is the higher income earner?”

- Do you expect any significant changes to any of the purchaser’s income producing potential? That is, does either party expect a career change that would significantly affect their income?

- When speaking to your solicitor it is important to emphasise that the property should be purchased as a “tenants in common” that is, where the ownership can be varied to the higher income earner, e.g. 99/1 the higher income earner legally owns 99% of the property (this does not determine assets in the event of a separation as the Family Law Court has a different view on splitting of assets than the legal ownership specified for tax purposes). If you do not discuss this with your solicitor they often put the default on a joint tenancy which is a 50/50 ownership.

- How negatively geared is the property? In the case of a positively geared property it may be prudent to have the low income earner have a higher percentage ownership of the property.

Loan Structures

Another commonly made mistake is having your loans incorrectly structured allowing tax and non-tax deductible amounts mixed together. You should ensure the following:

- Ensure that rent and all tax deductible costs for outgoings from your investment properties flow through a specially set up investment account. In recent years banks have offered interest offset accounts and the great thing about these accounts is that any balances can be offset against the tax deductible loans.

- It is very important that expenditure for personal purposes is not taken out of a deductible loan account as the ATO will require any future transactions in this account to be split between the tax and non-tax deductible components i.e. if you have a $100,000 deductible loan and then draw another $10,000 out for a holiday then you have a mixed loan which is only 90% deductible. If you repay that $10,000 back then the ATO will require you to apportion that repayment to 90% against the deductible loan and 10% against the non-deductible portion. You can however, refinance and spilt the tax and non-tax deductible components of these loans but there is considerable time and effort needed to correct previous errors. This is all contained tax ruling 2000/2.

David Shaw is the CEO of WSC Group: Certified Practising Accountants and Business Advisors, and

was voted Property Tax Specialist of the Year in the Your Investment Property 2013 Readers Choice Awards (as well as runner up in 2012 & 2014 ).

*The advice published on social media mediums by WSC Group is of a general nature and does not constitute specific financial advice. For a detailed financial strategy you should consult with a qualified financial advisor before making any investment decision.

Disclaimer: while due care is taken, the viewpoints expressed by contributors/sponsors do not necessarily reflect the opinions of Your Investment Property.