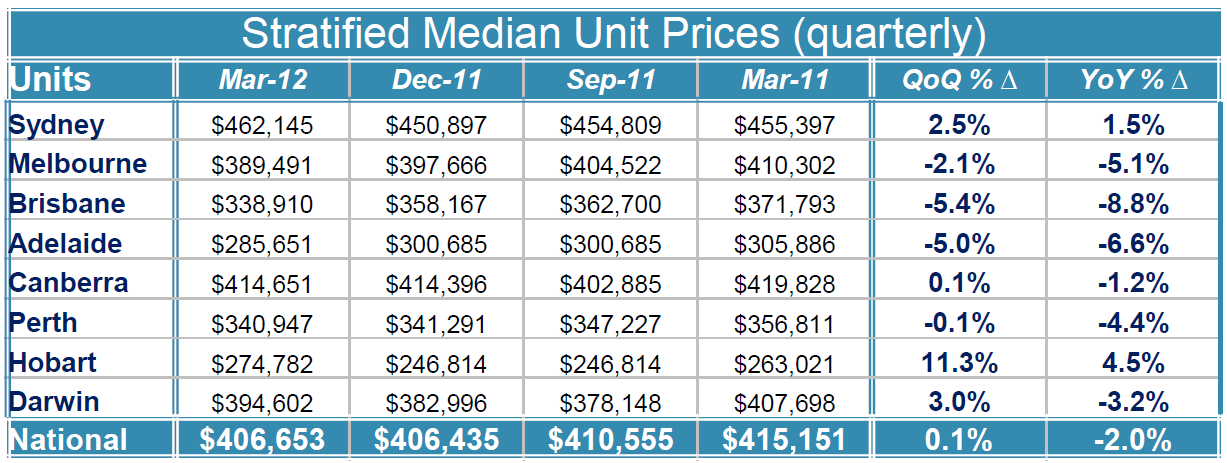

Which of our capital city markets recorded a median price drop of -8.8% over the past year? And which market saw a quarterly rise of 11.3%? Read on, and you may well be surprised by the results.

Brisbane units were the worst performing capital city property market in the 12 months to March, according to the latest House Price Report from Australian Property Monitors (APM), while units in Hobart recorded the best result – recording a median price rise of 4.5%.

Overall, year-on-year results in each of Australia’s capital city markets were less than spectacular, with Sydney units being the only other market other than Hobart units to record a median price increase (1.5%).

The median unit price across all capital cities dropped by -2% over the year, according to APM. The worst performer after Brisbane was Adelaide (-6.6%), followed by Melbourne (-5.1%) and Perth (-4.4%). The best performer after Hobart and Sydney was Canberra (-1.2%).

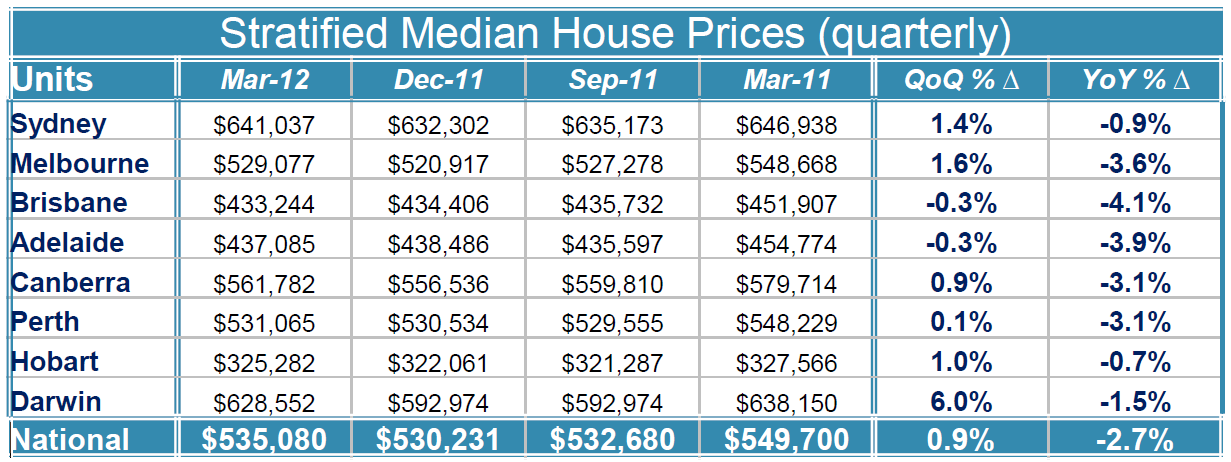

Houses fared worse than units overall, according to APM, recording a national year-on-year median price decline of -2.7%. The worst performers were Brisbane (-4.1%) and Adelaide (-3.9%), while Hobart (-0.7%) and Sydney (-0.9%) saw the smallest median price declines.

The more volatile quarterly figures provided some cause for optimism, with houses showing a median price rise of 0.9% and units recording a figure of 0.1% nationally. The biggest winners over the quarter were Hobart units, recording an impressive 11.3% rise, and Darwin houses (6%). The worst performers over the quarter were Brisbane units (-5.4%) and Adelaide units (-5%).

Encouraging signs

Noting that the median house prices rose in most Australian capital cities over the first three months of 2012, APM senior economist Andrew Wilson noted that “the national median house price rose by 0.9% with the median unit price rising by 0.1%, which is the first quarterly rise recorded since June 2010 – 20 months ago”.

He went on to label Darwin – the top performing house market over the quarter – as “volatile”, and pointed to encouraging signs for the Perth house market.

“Although Perth recorded a small rise of 0.1% this was nonetheless the second consecutive quarterly rise in the median house price, and signals a solid outcome considering the significant declines experienced by that market through 2010 and into 2011,” he said.

Meanwhile, Wilson believes that Sydney’s quarterly median price rises in both the house and unit markets represented the “continued resilience of the Sydney market”.

“The Perth, Brisbane and Sydney markets remain the best prospects for growth over 2012, and although the Melbourne market has been encouraging so far this year, this may prove to be short- lived if the Victorian economic performance continues to deteriorate,” he added.

“Early signs are certainly positive for most Australian housing markets in 2012 with the likelihood that buyer and seller confidence will continue to rise in 2012 after a subdued 2011.”

Which cities are you targeting this year? Have your say on our property investment forum.

More stories:

Resource states get thumbs up; doubts hang over Vic, Tas