Which capital city has seen its land values rise by 459% over the last 10 years? And which city’s land values have plummeted by $40 per square metre in three months? Read on for the surprising results.

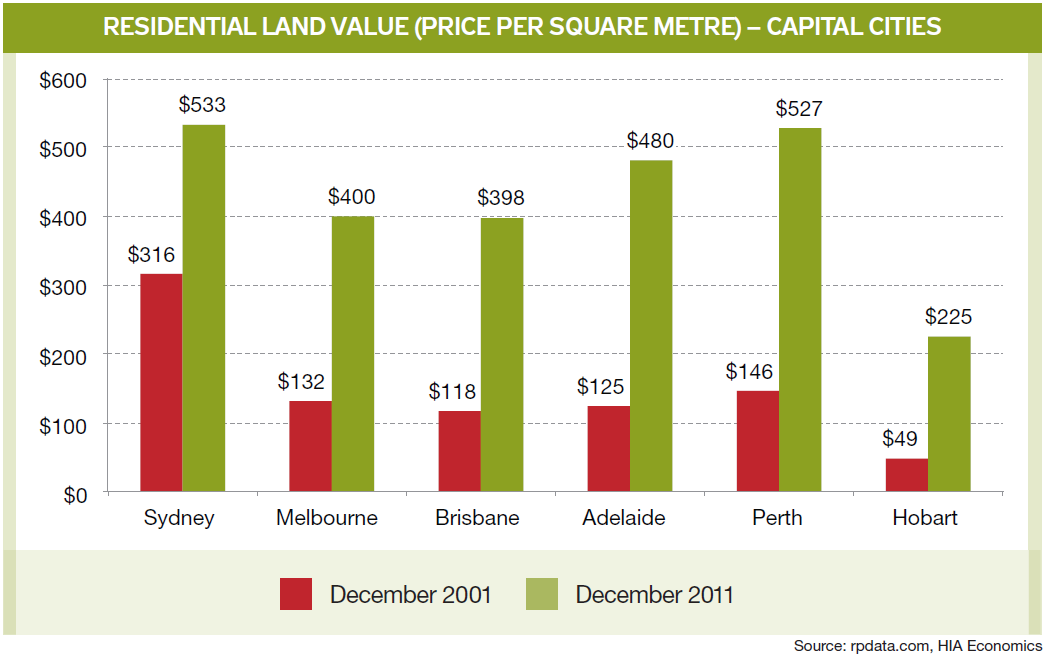

The average residential land value per square metre in Australia’s capital cities has risen by between 169% and 459% over the past 10 years, according to recently released data, and the best performers may come as a surprise.

Hobart recorded the most astonishing result. According to the HIA-RP Data Residential Land Report, its residential land price per square metre increased from $49 in 2001 to $225 in 2011 – a 459% price increase. Adelaide took second spot with its 384% increase (rising from $125 to $480 per square metre between 2001 and 2011), followed by Perth’s 362% increase ($146 to $527).

The city to record the lowest percentage increase was Sydney, whose residential land price per square metre increased from $316 in 2001 to $533 in 2011 – representing a percentage rise of 169%.

|

Dec-01 |

Dec-11 |

% Increase |

|

|

Sydney |

$316 |

$533 |

169% |

|

Melbourne |

$132 |

$400 |

303% |

|

Brisbane |

$118 |

$398 |

337% |

|

Adelaide |

$125 |

$480 |

384% |

|

Perth |

$146 |

$527 |

361% |

|

Hobart |

$49 |

$225 |

459% |

Source: rpdata.com, HIA Economics

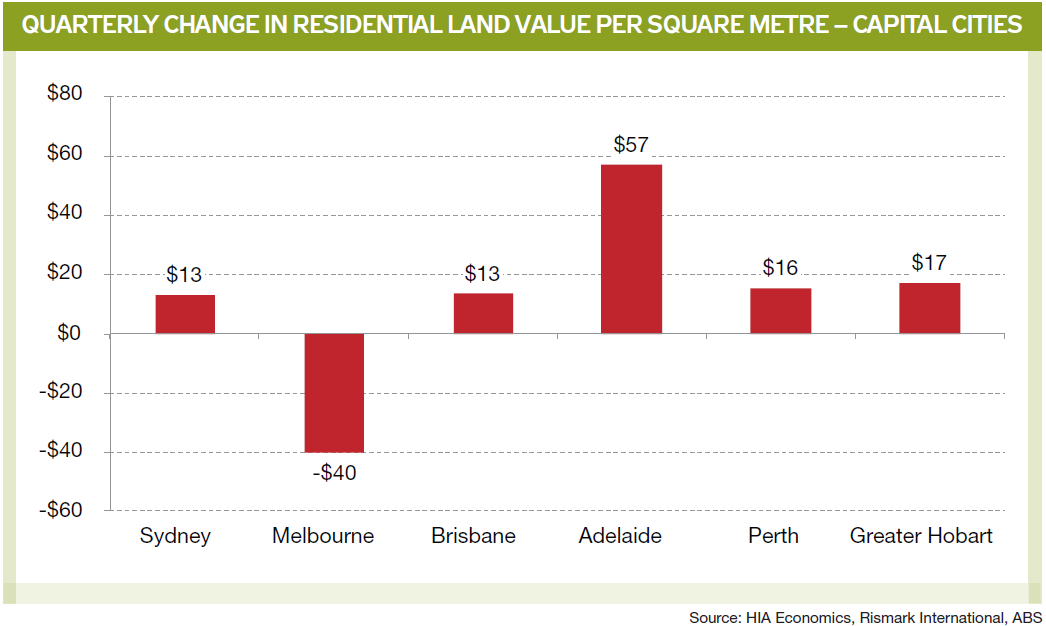

Recent times, however, tell a slightly different story, with Adelaide scoring by far the highest land price rise over the final quarter of 2011 ($57). Hobart takes second place ($17), followed by Perth ($16) and Sydney/Brisbane ($13). In worrying signs for the Melbourne property market however, its per square metre land value dropped by -$40 over the quarter. (Darwin and Canberra figures were not included in the report).

Melbourne’s median lot price dropped by 1.1% over the quarter, but a 6.1% increase in the overall number of lot sales over the same period showed tentative signs of a recovery in the Melbourne land market. The report warns Melbourne investors not to get too ahead of themselves, however.

“Before we get too excited, it should be noted that the volume of sales in the December 2010 quarter were the lowest on record. Furthermore, the average number of sales over the last five quarters is 53% lower than the longer term average. Basically, we don’t see this as the green shoots of recovery in Melbourne’s lot sales, but rather at best, a ‘bouncing around the bottom’ effect, with hopefully not too many more significant declines ahead,” says the report.

Overall, Sydney remains the country’s most expensive capital city in which to buy land on a per square metre basis ($533), followed by Perth ($527) and Adelaide ($480). Despite its phenomenal percentage increase over the past decade, Hobart remains the cheapest of the six capital city land markets identified in the report at $225 per square metre.

How do land values affect your property investment decisions? Join the debate on our property investment forum.

More stories:

The cheapest places to buy land

Foreign investors raid the Aussie property market

Show me the money: Australia’s richest and poorest states revealed