Foreign hunger for Australian property shows no signs of abating, with overseas investors spending a whopping $41.5bn on Australian real estate last financial year. Which countries’ residents are raiding the Australian market? Read on for the surprising results.

According to the latest figures from the Foreign Investment Review Board (FIRB), released in its Annual Report 2010-11, the British love affair with all things Australian certainly seems to extend to property, with FIRB approvals for investments in real estate by UK residents topping the scales at $4,610m.

China’s inroads into the Australian property market saw it take the second spot ($4,093m), followed by the USA ($3,404m). Malaysia ($1,863m) and the Netherlands ($1,691m) complete the top five.

Approvals by country of investor in 2010-11

|

Country |

Real estate ($m) |

|

UK |

4,610 |

|

China |

4,093 |

|

US |

3,404 |

|

Malaysia |

1,863 |

|

Netherlands |

1,691 |

|

Singapore |

1,487 |

|

Germany |

1,128 |

|

United Arab Emirates |

1,088 |

|

South Africa |

826 |

|

Canada |

807 |

|

Japan |

598 |

|

South Korea |

497 |

|

Switzerland |

455 |

|

Spain |

407 |

|

Hong Kong |

404 |

|

Russia |

245 |

|

India |

163 |

|

New Zealand |

64 |

|

France |

45 |

|

Thailand |

13 |

|

Other |

11,873 |

Source: FIRB Annual Report 2010-11

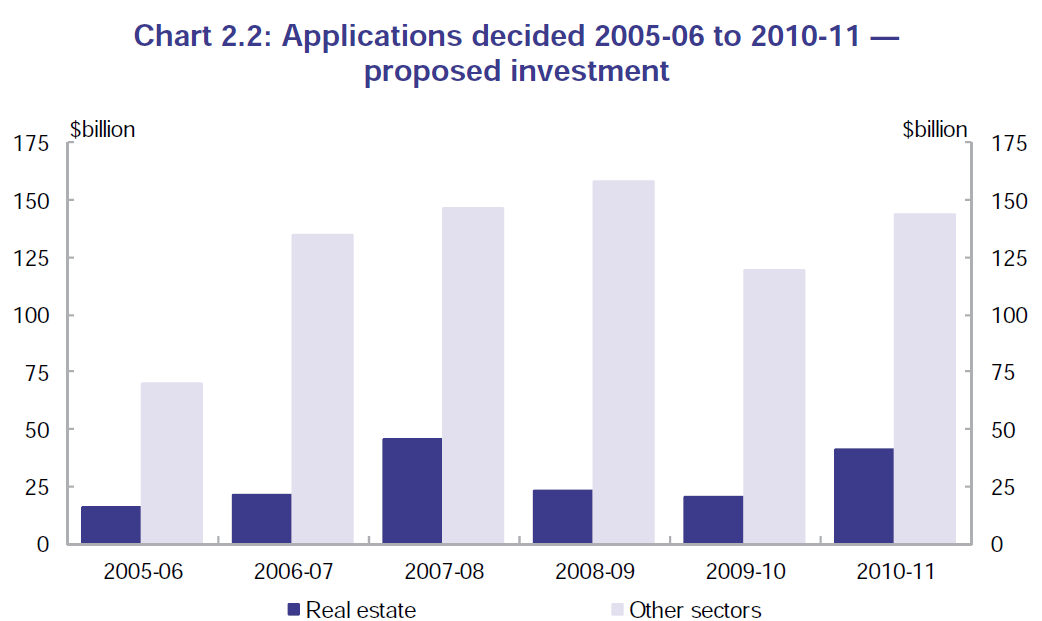

The overall value of approved investment in real estate was $41.5bn in 2010-11, notes the FIRB report, which was more than double the 2009-10 figure of $20 billion in 2009-10. In the residential sector, the numbers increased from $8.88bn to $20.92bn over the same period. The report notes however that “these figures were affected by changes to the policy and administrative arrangements for residential property and in no regard do they provide a comparable view of investment activity in this sector”.

Source: FIRB Annual Report 2010-11

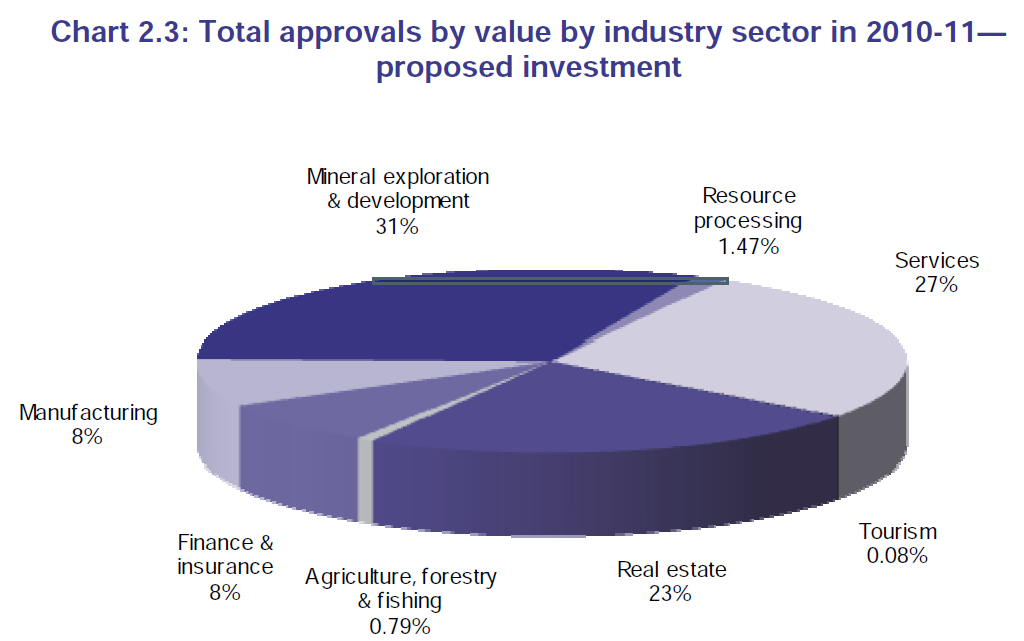

In terms of the overall number of FIRB approvals, real estate was the third most popular industry sector among foreign investors in 2010-11, accounting for 23% of all approvals. Mineral exploration and development (31%) and services (27%) took the top two spots.

.png)

Source: FIRB Annual Report 2010-11

Source: FIRB Annual Report 2010-11

Is foreign investment good or bad for the Australian property market? Have your say on our property investment forum.

More stories:

The cheapest places to buy land

Show me the money: Australia’s richest and poorest states revealed