3/07/2018

More Australians than ever before are now trying their hand at the property investment game, rendering the market an increasingly crowded and competitive space. However, one industry veteran says there’s an area that remains largely overlooked and that can deliver impressive returns to investors.

Defined as a “boarding house, guest house, hostel or the like” by the Australian Building Codes Board, Class 1B category buildings require far less paperwork and planning compared to traditional dwellings, so investors are able to circumnavigate the reams of red tape often associated with property developments.

“Because the land is zoned Res 1, generally little or no planning permission is required,” says Frank Days, a property specialist at Modo Project Builders. “This saves on costs associated with planning and time – in fact, we can have the keys to an investor within six months of breaking ground.”

The Victoria-based building and design team specialises in shared accommodation and has an in-depth knowledge of the various legislative requirements that a building must meet in order to be properly categorised.

However, Modo has moved away from the dated and often-problematic boarding house concept in favour of modern, self-contained spaces, which are highly sought after by tenants today.

“Our 1B properties offer a positive cash flow asset that’s easily let due to the high standard of finish and the overall appeal,” says Days.

“Our designs will look fantastic in any streetscape and maximise space for tenants and yield for owners.”

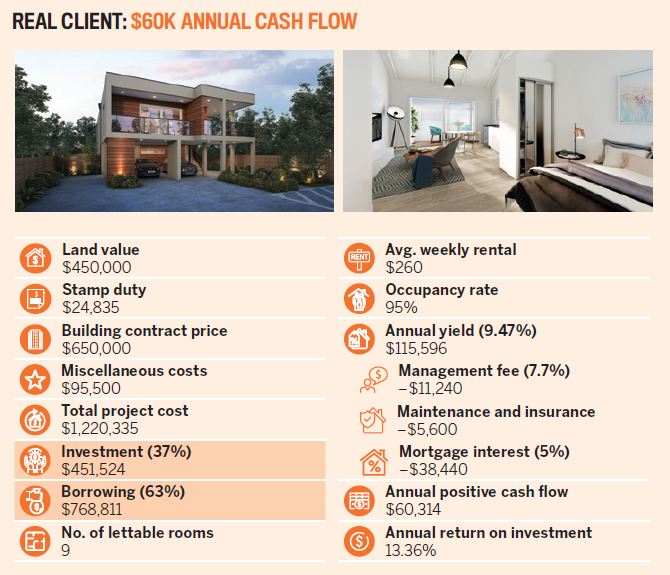

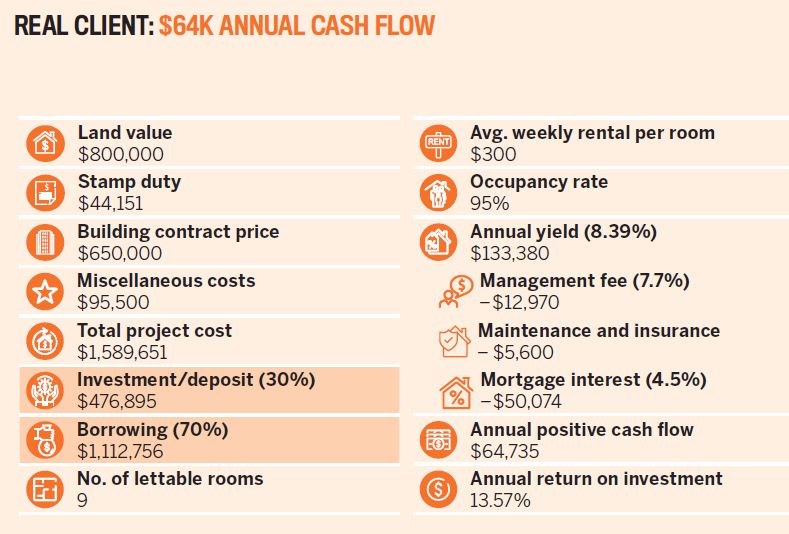

The set-up provides several streams of income, with up to nine lettable rooms, each with their own en suite and wet bar. The overall building also includes a communal kitchen and laundry.

“It is very much about providing tenants with a clean, safe space that is affordable,” says Days, who notes that there’s also a financial incentive for owners who provide the modestly priced accommodation.

According to the State Revenue Office of Victoria, land may be exempt from land tax if it is registered as a rooming house, and if the weekly rent is kept below $313.04 per person for a single room or $235.97 per person for a shared room.

Further financial peace of mind also comes from the potential multiple income avenues. If one tenant moves out, owners are minimally impacted and can expect to fill a vacancy almost immediately, as the rooms are in high demand.

“There is a growing demographic of Australians looking for this type of accommodation, and we regularly see these fully tenanted within four or five weeks,” says Days.

While some investors express concern about the type of tenant that will occupy low-cost shared accommodation, Days says it’s a misconception that 1B buildings largely attract transient or unreliable tenants.

“We build a lot of these very close to universities and hospitals, thinking we might get students or junior doctors and nurses, but we’ve actually found over the years that we get everyone,” says Days. “One of the largest-growing markets is actually the single over-50s.”

While 1B buildings are yet to experience a boom, Days says it won’t be long before savvy investors begin to realise the potential of shared housing.

“It’s absolutely one of the spaces that’s not really well known, but we’re finding with our clients that once they get onto it, they’re building multiple of these rather than investing in apartments or townhouses,” he says. “We’ve got one accountant who’s currently building his fifth.”

Essentially, it all comes down to making the most out of the space an investor has. “When looking at yields it’s important to maximise the space you have available – obviously, units and townhouses do this better than a house, but none are as effective as a 1B property,” says Days.

“1B buildings are the game changer; it’s as simple as that.” For investors who already have a site earmarked for development, Modo can tailor-make a property to best suit individual budgets, local environments and long-term expectations.

“We aren’t speculative builders and will work with our clients to design and build specific to their requirements,” says Days. “We can either work with standard plans and specifications or we can start from scratch and create a totally new, unique and individual design. We’ll even build to lock-up stage only, if that is what’s required.”

However, investors who are yet to identify a plot of land aren’t exempt from the opportunity, as Modo has partnered with a wide network of real estate agents who source off-market properties that are suitable for redevelopment.

“At the moment, I’m dealing with three clients who don’t have their own land ready to go, so we’re actively trying to source something for them,” says Days. “Our goal is to make your experience both enjoyable and rewarding without the stress and drama you often hear about.”