Property investing is a constantly evolving journey, and those on this path are often searching for new and different ways to advance their portfolios.

Some investors find success in transforming a home to add value, with a few strategic renovations boosting their property wealth. This desire to improve on an existing space often becomes a stepping stone towards property development, which provides an opportunity for investors to seriously supercharge their profit.

“I can’t tell you how many people have told me that they’d love to get into property development. Almost every BBQ I’ve attended for the last 15 years has led to the discussion, and I’m pleased to say that I have a handful of friends who got into the market a few years ago, who are now doing a small project every other year,” says OpenCorp director Matthew Lewison.

“It’s really helped them to grow their wealth beyond what their existing passive residential portfolios could have done. But today, those same guys would struggle if they were trying to get started as first-time developers. The landscape for finding, financing and getting planning for a small development is significantly harder than it was.”

Understanding why you’re developing is a crucial precursor to determining how you’re going to do it, Lewison says. As with everything to do with property, it’s essential that you learn about the different facets of developing, as it involves much more than simply buying, building and making a profit.

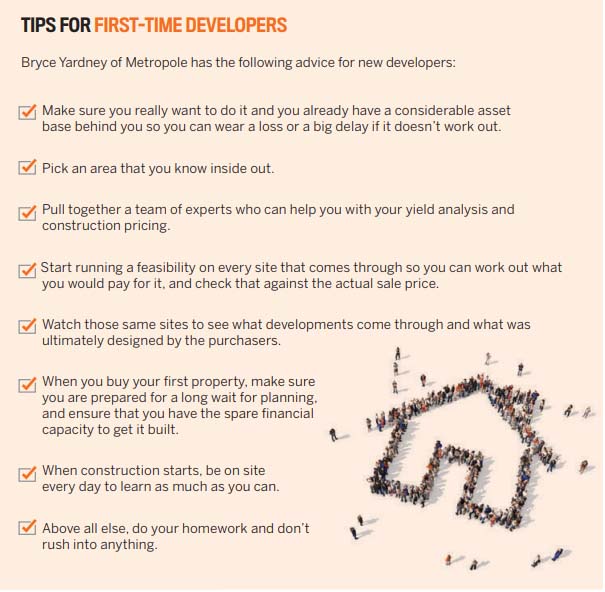

“A great place for budding developers to start is by getting involved in property renovations – in fact, that’s how many experienced developers initially learned their trade,” says Bryce Yardney, a property development expert who heads up Metropole’s property management division.

“Some property investors move into the realm of property development not understanding the rules of the game are very different. They don’t know what they don’t know and they get caught.”

But while property development comes with a lot of upsides, it certainly has its downsides, as residential developer Chris Byhouwer’s story illustrates. Over an investment journey spanning about 30 years, he’s developed more than a dozen properties, with varying results.

“I knew there were profits to be made in real estate, so I just kept trying different things,” Byhouwer explains.

Since fully renovating a two-bedroom house he purchased in Bowhill, SA, in 2009, he has been enjoying a 12% return on rent. Then in 2014 he demolished a house in Clearview, SA, and subdivided the land, which he onsold for a net profit of $75,000.

His most profitable transaction to date involved a corner block purchased in Adelaide in July 2013. “I bought it for $350,000 and spent $100,000 on renovations and the subdivision. I sold the house for $347,000 and the rear block for $210,000, making a profit of $107,000 in just nine weeks.”

That said, although many of his renovation and development projects have been profitable, Byhouwer has discovered that the process is not foolproof. He has occasionally purchased properties in areas where growth has flatlined, and he’s made losses on deals that didn’t pan out – such as in 2006, when due to misinformation from the local council he bought a piece of land that he was unable to develop.

“After that experience, I learned to do more research, and I no longer believe what a council representative tells me over the counter,” he says.

“After that experience, I learned to do more research, and I no longer believe what a council representative tells me over the counter,” he says.

Byhouwer has also embarked on development projects that, despite his best efforts at due diligence and careful planning, didn’t turn a profit.

“Most of my deals did show a profit, but in the ones that didn’t, extra delays with council, an unknown flood zone that even the council couldn’t give me a clear answer on, and not getting a clearer picture of the end buyer have been my stumbling blocks,” Byhouwer says.

Situations such as these highlight the risks that potential developers need to consider. Before you look at going down this path, here are a few of the risks to keep in mind:

1. Buying in the wrong place

A property may boast an excellent location near amenities or close to the city, but that doesn’t mean it is well suited to development. It’s important to review the local area for development success and check with the local council to determine the rules on making major changes, for example to plumbing.

2. Developing at the wrong time

You need to keep an eye on the property cycle to ensure that an investment is likely to appreciate in value once the work is done. A downturn could wind up wasting all the effort and money put into construction.

“A great place for budding developers to start is property renovations – that’s how many experienced developers initially learned their trade”

3. Council disapproval

Yardney says getting approvals for developments has not been easy of late. “Councils are currently very slow in assessing development applications, and they reject many. Not obtaining an approval or obtaining one on unfavourable terms is a growing risk for developers,” he says. “The cost of obtaining approval or fighting council’s rejection in a court of appeal is continually rising.”

4 Rising costs

An increase in interest rates could cause holding expenses to go up, limiting the profit you gain. Construction costs could also increase, taking an unexpected chunk out of your budget. “It’s not unusual for a planning application to take anywhere from 12 to 18 months to get through,” Lewison says. “Add a nine-to-12-month construction period and a small project has increased from a one-year investment (in the ’90s) to a minimum of three years today. Banks now also want developers to presell their units before they will provide construction finance.”

5. Conflicts

In the process of developing, you work with many different tradies and suppliers. This can result in disagreements and disputes between parties, which in turn lead to delays on the project.

Ultimately, developing property wisely and effectively comes down to how well you plan things before you begin.

“When you buy your first property, make sure you are prepared for a long wait for planning, and ensure that you have spare financial capacity to get it built!” Lewison says.